by John Nyiszter | Apr 8, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners |

Don’t Let Your Student Loans Delay Your Homeownership Plans

If you have student loans and want to buy a home, you might have questions about how your debt affects your plans. Do you have to wait until you’ve paid off those loans before you can buy your first home? Or is it possible you could still qualify for a home loan even with that debt? Here’s a look at the latest information so you have the answers you need.

A Bankrate article explains:

“Roughly 60 percent of U.S. adults who have held student loan debt have put off making important financial decisions due to that debt . . . For Gen Z and millennial borrowers alone, that number rises to 70 percent.”

This includes one of the biggest financial decisions you’ll ever make, buying a home. But you should know, even with student loans, waiting to buy a home may not be necessary. While everyone’s situation is unique, your goal may be more within your reach than you realize. Here’s why.

Can You Qualify for a Home Loan if You Have Student Loans?

According to an annual report from the National Association of Realtors (NAR), 38% of first-time buyers had student loan debt and the typical amount was $30,000.

That means other people in a similar situation were able to qualify for and buy a home even though they also had student loans. And you may be able to do the same, especially if you have a steady source of income. As an article from Bankrate says:

“. . . you can have student loans and a mortgage at the same time. . . . If you have student loans and want a mortgage, there are multiple home loan programs you might qualify for . . .”

The key takeaway is, for many people, homeownership is achievable even with student loans.

You don’t have to figure this out on your own. The best way to make a decision about your goals and next steps is to talk to the professionals. A trusted lender can walk you through your options based on your situation, and share what’s worked for other buyers.

Bottom Line

Lots of other people with student loan debt are able to buy their own homes. Talk to a lender to go over your options and see how close you are to reaching your goal.

by John Nyiszter | Mar 29, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized |

Is It Easier To Find a Home To Buy Now?

One of the biggest hurdles buyers have faced over the past few years has been a lack of homes available for sale. But that’s starting to change.

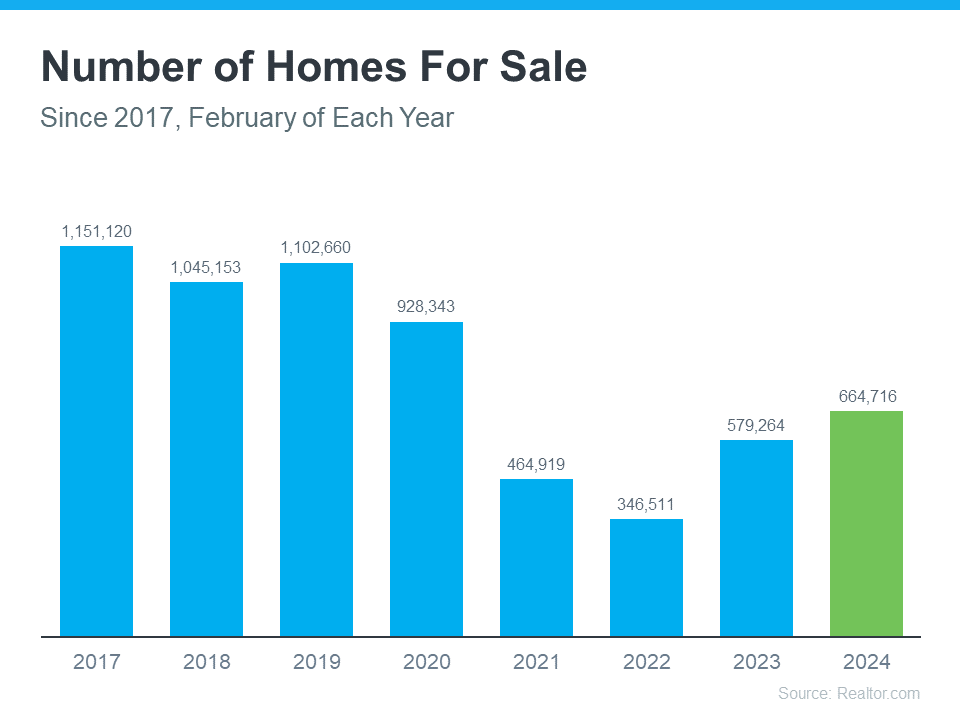

The graph below uses the latest data from Realtor.com to show there are more homes on the market in 2024 than there have been in any of the past several years (2021-2023):

Does That Mean Finding a Home Is Easier?

The answer is yes, and no. As an article from Realtor.com says:

“There were nearly 15% more homes for sale in February than a year earlier . . . That alone could jolt the housing market a bit if more “For Sale” signs continue to appear. However, the nation is still suffering from a housing shortage even with all of that new inventory.”

Context is important. On the one hand, inventory is up over the past few years. That means you’ll likely have more options to choose from as you search for your next home.

But, at the same time, the graph above also shows there are still significantly fewer homes for sale than there would usually be in a more normal, pre-pandemic market. And that deficit isn’t going to be reversed overnight.

What Does This Mean for You?

You might find a few more choices now than in recent years, but you shouldn’t expect a ton of options.

To help you explore the growing list of choices you have now, team up with a local real estate agent you trust. They can really help you understand the inventory situation where you want to buy. That’s because real estate is local. An experienced agent can share some smart tips they’ve used to help other buyers in your area deal with ongoing low housing supply.

Bottom Line

If you’re thinking about buying a home, let’s team up. That way, you’ll be up to date on everything that could affect your move, including how many homes are for sale right now.

by John Nyiszter | Mar 29, 2024 | condos, First Time Home Buyers, Home Owners, Home Sellers, luxury homes, townhome owners |

Single Women Are Embracing Homeownership

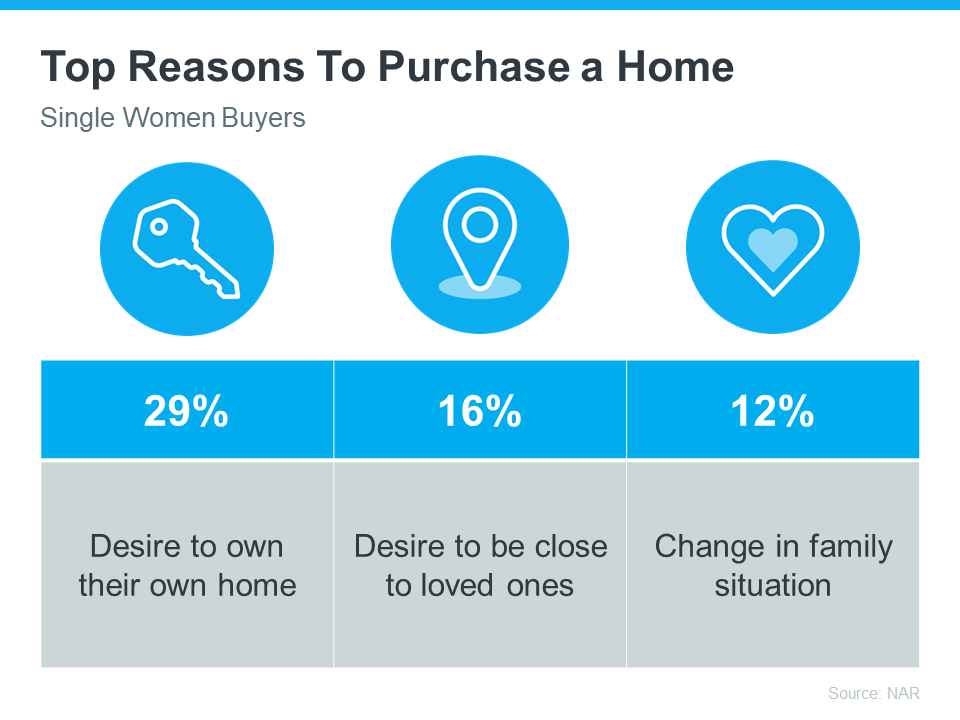

In today’s housing market, more and more single women are becoming homeowners. According to data from the National Association of Realtors (NAR), 19% of all homebuyers are single women, while only 10% are single men.

If you’re a single woman trying to buy your first home, this should be encouraging. It means other people are making their dreams a reality – so you can too.

Why Homeownership Matters to So Many Women

For many single women, buying a home isn’t just about having a place to live—it’s also a smart way to invest for the future. Homes usually increase in value over time, so they’re a great way to build equity and overall net worth. Ksenia Potapov, Economist at First American, says:

“. . . single women are increasingly pursuing homeownership and reaping its wealth creation benefits.”

The financial security and independence homeownership provides can be life-changing. And when you factor in the personal motivations behind buying a home, that impact becomes even clearer.

The same report from NAR shares the top reasons single women are buying a home right now, and the reality is, they’re not all financial (see chart below):

If any of these reasons resonate with you, maybe it’s time for you to buy too.

Work with a Trusted Real Estate Agent

If you’re a single woman looking to buy a home, it is possible, even in today’s housing market. You’ll just want to be sure you have a great real estate agent by your side.

Talk about what your goals are and why homeownership is so important to you. That way your agent can keep what’s critical for you up front as they guide you through the buying process. They’ll help you find the right home for your needs and advocate for you during negotiations. Together, you can make your dream of homeownership a reality.

Bottom Line

Homeownership is life-changing no matter who you are. Let’s connect today to talk about your goals in the housing market.

by John Nyiszter | Mar 26, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

What’s the Latest with Mortgage Rates?

Recent headlines may leave you wondering what’s next for mortgage rates. Maybe you’d previously heard there were going to be cuts this year that would bring rates down. That refers to the Federal Reserve (the Fed) and what they do to their Fed Funds Rate. While cutting, or lowering, the Fed Funds Rate doesn’t directly determine mortgage rates, it does tend to impact them. But when the Fed met last week, a cut didn’t happen — at least, not yet.

There are a lot of factors the Fed considered in their recent decision and most of them are complex. But you don’t need to be bogged down by those finer details. What you really want is the answer to this question: does that mean mortgage rates aren’t going to fall? Here’s what you need to know.

Mortgage Rates Are Still Expected To Drop This Year

While it hasn’t happened yet, that doesn’t mean it won’t. Even Jerome Powell, the Chairman of the Fed, says they still plan to make cuts this year, assuming inflation cools:

“We believe that our policy rate is likely at its peak for this tightening cycle and that, if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”

When this happens, history shows mortgage rates will likely follow. That means hope isn’t lost. As a recent article from Business Insider explains:

“As inflation comes down and the Fed is able to start lowering rates, mortgage rates should go down, too. . .”

What This Means for You

But you don’t necessarily want to wait for it to happen. Mortgage rates are notoriously hard to forecast. There are so many factors at play and any one of those can change the projections as the economy shifts. And it’s why the experts offer this advice. As Mark Fleming, Chief Economist at First American, says:

“Well, mortgage rate projections are just that, projections, not promises and don’t forget how hard it is to forecast them. . . So my advice is to never try to time the market . . . If one is financially prepared and buying a home aligns with your lifestyle goals, then it could be the right time to purchase. And there’s always the refinance option if mortgage rates are lower in the future.”

Basically, if you’re looking to move and trying to time the market, don’t. If you’re ready, willing, and able to move, it may still be worth it to do it now, especially if you can find the home you’ve been searching for.

Bottom Line

If you’re looking to buy a home, let’s connect so you have someone keeping you up-to-date on mortgage rates and helping you make the best decision possible.

by John Nyiszter | Mar 22, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners

Some Highlights

by John Nyiszter | Mar 20, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

Does It Make Sense To Buy a Home Right Now?

Thinking about buying a home? If so, you’re probably wondering: should I buy now or wait? Nobody can make that decision for you, but here’s some information that can help you decide.

What’s Next for Home Prices?

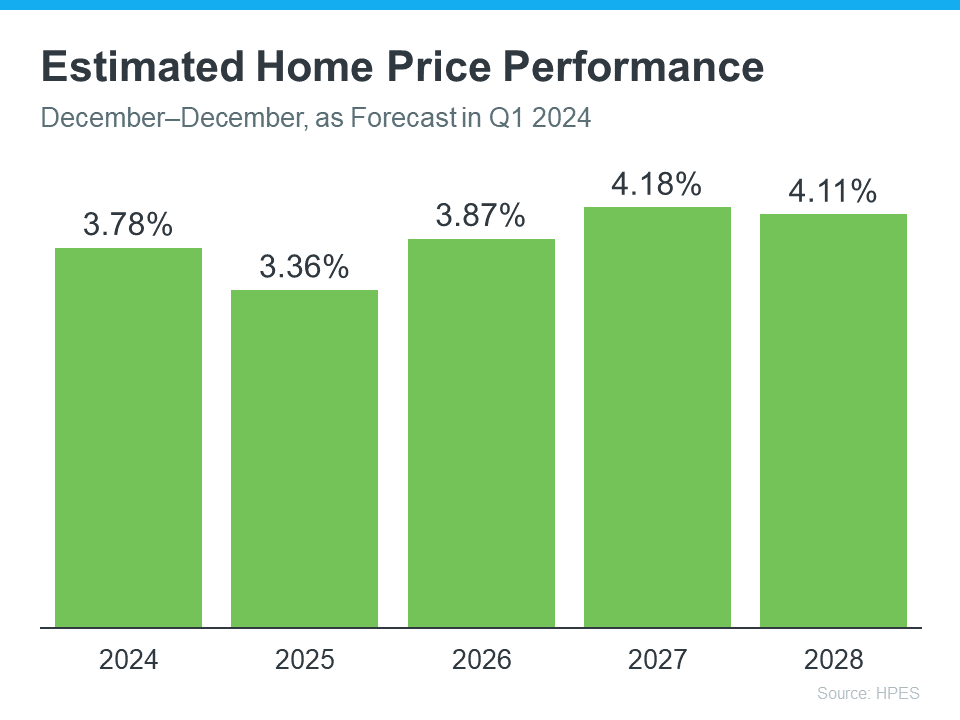

Each quarter, Fannie Mae and Pulsenomics publish the results of the Home Price Expectations Survey (HPES). It asks more than 100 experts—economists, real estate professionals, and investment and market strategists—what they think will happen with home prices.

In the latest survey, those experts say home prices are going to keep going up for the next five years (see graph below):

Here’s what all the green on this chart should tell you. They’re not expecting any price declines. Instead, they’re saying we’ll see a 3-4% rise each year.

And even though home prices aren’t expected to climb by as much in 2025 as they are 2024, keep in mind these increases can really add up over time. It works like this. If these experts are right and your home’s value goes up by 3.78% this year, it’s set to grow another 3.36% next year. And another 3.87% the year after that.

What Does This Mean for You?

Knowing that prices are forecasted to keep going up should make you feel good about buying a home. That’s because it means your home is an asset that’s projected to grow in value in the years ahead.

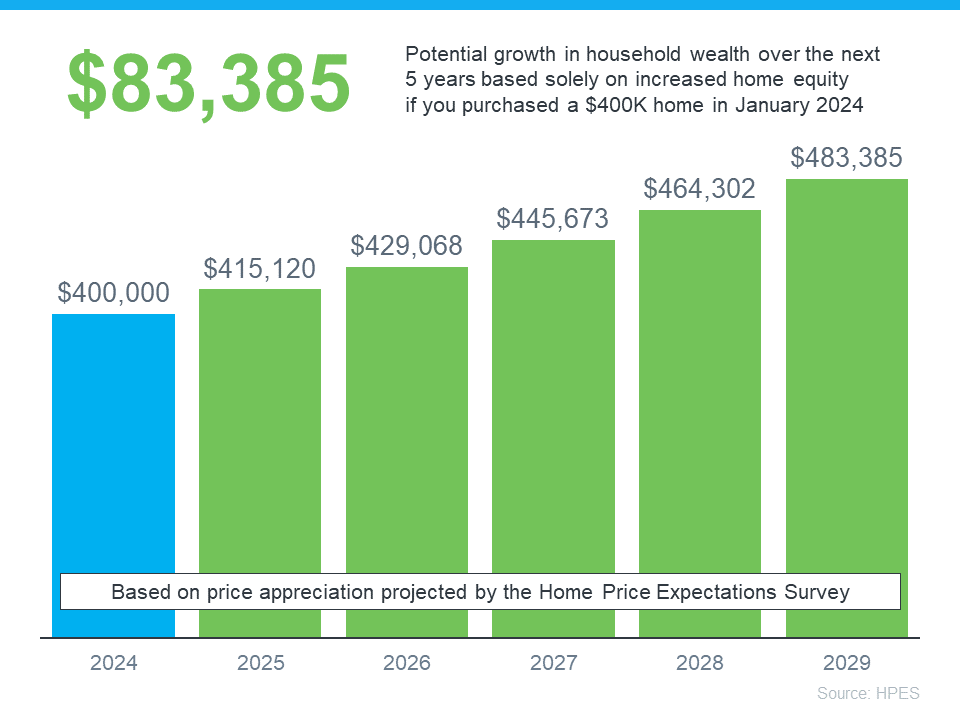

If you’re not convinced yet, maybe these numbers will get your attention. They show how a typical home’s value could change over the next few years using expert projections from the HPES. Check out the graph below:

In this example, imagine you bought a home for $400,000 at the start of this year. Based on these projections, you could end up gaining over $83,000 in household wealth over the next five years as your home grows in value.

Of course, you could also wait – but if you do, buying a home is just going to end up costing you more.

Bottom Line

If you’re thinking it’s time to get your own place, and you’re ready and able to do so, buying now might make sense. Your home is expected to keep getting more valuable as prices go up. Let’s team up to start looking for your next home today.