by John Nyiszter | Mar 4, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

If you want to buy a home, you should know your credit score is a critical piece of the puzzle when it comes to qualifying for a mortgage. Lenders review your credit to see if you typically make payments on time, pay back debts, and more. Your credit score can also help determine your mortgage rate. An article from US Bank explains:

“A credit score isn’t the only deciding factor on your mortgage application, but it’s a significant one. So, when you’re house shopping, it’s important to know where your credit stands and how to use it to get the best mortgage rate possible.”

That means your credit score may feel even more important to your homebuying plans right now since mortgage rates are a key factor in affordability. According to the Federal Reserve Bank of New York, the median credit score in the U.S. for those taking out a mortgage is 770. But that doesn’t mean your credit score has to be perfect. The same article from US Bank explains:

“Your credit score (commonly called a FICO Score) can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you don’t need that score or above to buy a home.”

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan and the mortgage rate you’re able to get. As FICO says:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders may use to determine your actual interest rates.”

If you’re looking for ways to improve your score, Experian highlights some things you may want to focus on:

- Your Payment History: Late payments can have a negative impact by dropping your score. Focus on making payments on time and paying any existing late charges quickly.

- Your Debt Amount (relative to your credit limits): When it comes to your available credit amount, the less you’re using, the better. Focus on keeping this number as low as possible.

- Credit Applications: If you’re looking to buy something, don’t apply for additional credit. When you apply for new credit, it could result in a hard inquiry on your credit that drops your score.

Bottom Line

Finding ways to make your credit score better could help you get a lower mortgage rate. If you want to learn more, talk to a trusted lender.

by John Nyiszter | Feb 29, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

Over the past few months, experts have revised their 2024 home price forecasts based on the latest data and market signals, and they’re even more confident prices will rise, not fall.

So, let’s see exactly how experts’ thinking has shifted – and what’s caused the change.

2024 Home Price Forecasts: Then and Now

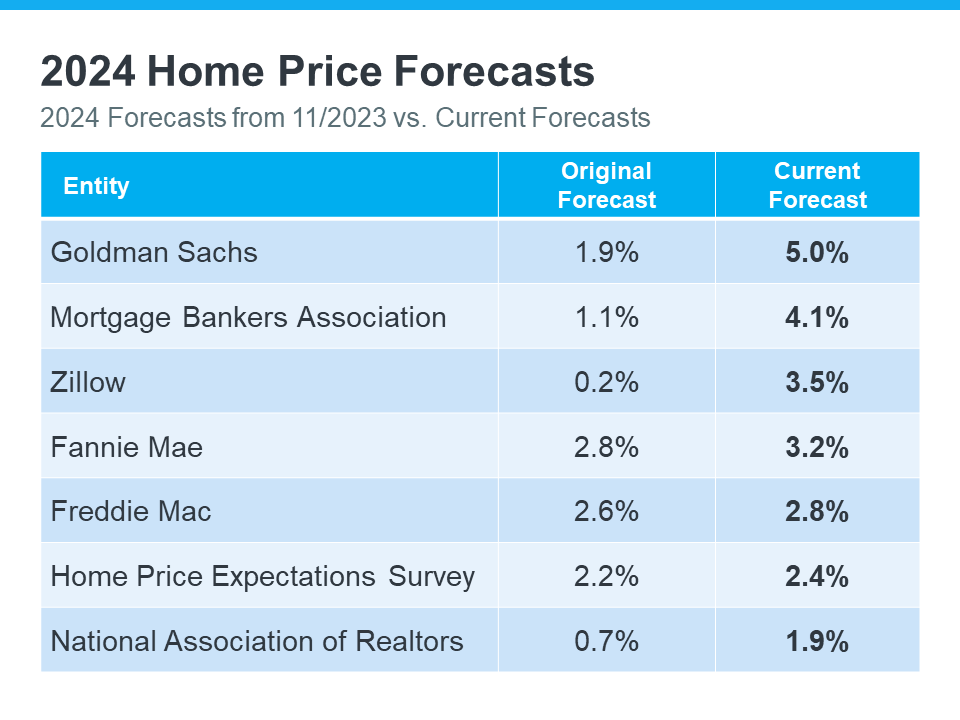

The chart below shows what seven expert organizations think will happen to home prices in 2024. It compares their first 2024 home price forecasts (made at the end of 2023) with their newest projections:

The middle column shows that, at first, these experts thought home prices would only go up a little this year. But if you look at the column on the right, you’ll see they’ve all updated their forecasts and now think prices will go up more than they originally thought. And some of the differences are major.

There are two big factors keeping such strong upward pressure on home prices. The first is how few homes are for sale right now. According to Business Insider:

“Low home inventory is a chronic problem in the US. This has generally kept home prices up . . .”

A lack of housing inventory has been pushing prices up for a long time now – and that’s not expected to change dramatically this year. But what has changed a bit is mortgage rates.

Late last year when most housing market experts were calling for home prices to rise only a little bit in 2024, mortgage rates were up and buyer demand was more moderate.

Now that rates have come down from their peak last October, and with further declines expected over the course of the year, buyer demand has picked up. That increase in demand, along with an ongoing lack of inventory, is what’s caused the experts to feel the upward pressure on prices will be stronger than they expected a couple months ago.

A Look Forward To Get Ahead of the Next Forecast Revisions

Real estate experts regularly revise their home price forecasts as the housing market shifts. It’s a normal part of their job that ensures their projections are always up-to-date and factor in the latest changes in the housing market.

That means they’ll continue to revise their projections as the housing market changes, just as they’ve always done. How those forecasts change next is anyone’s guess, but pay attention to mortgage rates.

If they trend down as the year goes on, as they’re expected to do, that could lead to more buyer demand and even higher home price forecasts.

Basically, it’s all about supply and demand. With supply still so limited, anything that causes demand to go up will likely cause prices to go up, too.

Bottom Line

At first, experts believed home prices would only go up a little this year. But now, they’ve changed their minds and forecast prices will grow even more than they originally thought. Let’s connect so you know what to expect with prices in our area.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

by John Nyiszter | Feb 29, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

Wondering if it still makes sense to sell your house right now? The short answer is, yes. And if you look at the current number of homes for sale, you’ll see two reasons why.

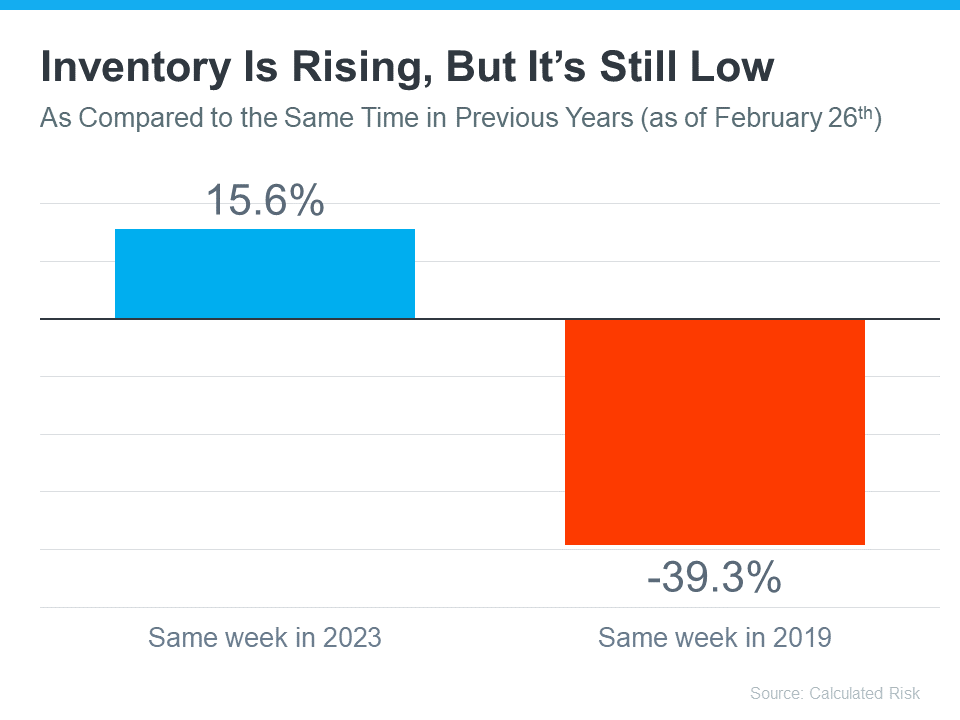

An article from Calculated Risk shows there are 15.6% more homes for sale now compared to the same week last year. That tells us inventory has grown. But going back to 2019, the last normal year in the housing market, there are nearly 40% fewer homes available now:

Here’s a breakdown of how this benefits you when you sell.

1. You Have More Options for Your Move

Are you thinking about selling because your current house is too big, too small, or because your needs have changed? If so, the year-over-year growth gives you more options for your home search. That means it may be less of a challenge to find what you’re looking for.

So, if you were holding off on selling because you were worried you weren’t going to find a home you like, this may be just the good news you needed. Partnering with a local real estate professional can help you make sure you’re up to date on the homes available in your area.

2. You Still Won’t Have Much Competition When You Sell

But to put that into perspective, even though there are more homes for sale now, there still aren’t as many as there’d be in a normal year. Remember, the data from Calculated Risk shows we’re down nearly 40% compared to 2019. And that large a deficit won’t be solved overnight. As a recent article from Realtor.com explains:

“. . . the number of homes for sale and new listing activity continues to improve compared to last year. However the inventory of homes for sale still has a long journey back to pre-pandemic levels.”

For you, that means if you work with an agent to price your house right, it should still get a lot of attention from eager buyers and could sell fast.

Bottom Line

If you’re a homeowner looking to sell, now’s a good time. You’ll have more options when buying your next home, and there’s still not a ton of competition from other sellers. If you’re ready to move, let’s connect to get the ball rolling.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

by John Nyiszter | Feb 29, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

If you’re holding out hope that the housing market is going to crash and bring home prices back down, here’s a look at what the data shows. And spoiler alert: that’s not in the cards. Instead, experts say home prices are going to keep going up.

Today’s market is very different than it was before the housing crash in 2008. Here’s why.

It’s Harder To Get a Loan Now – and That’s Actually a Good Thing

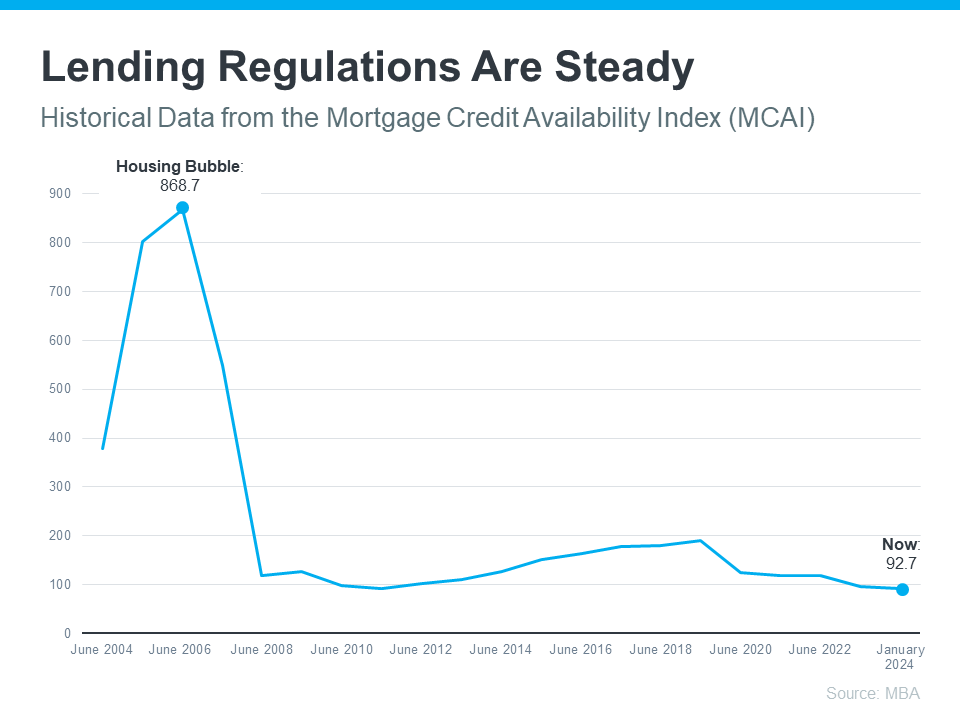

It was much easier to get a home loan during the lead-up to the 2008 housing crisis than it is today. Back then, banks had different lending standards, making it easy for just about anyone to qualify for a home loan or refinance an existing one.

Things are different today. Homebuyers face increasingly higher standards from mortgage companies. The graph below uses data from the Mortgage Bankers Association (MBA) to show this difference. The lower the number, the harder it is to get a mortgage. The higher the number, the easier it is:

The peak in the graph shows that, back then, lending standards weren’t as strict as they are now. That means lending institutions took on much greater risk in both the person and the mortgage products offered around the crash. That led to mass defaults and a flood of foreclosures coming onto the market.

There Are Far Fewer Homes for Sale Today, so Prices Won’t Crash

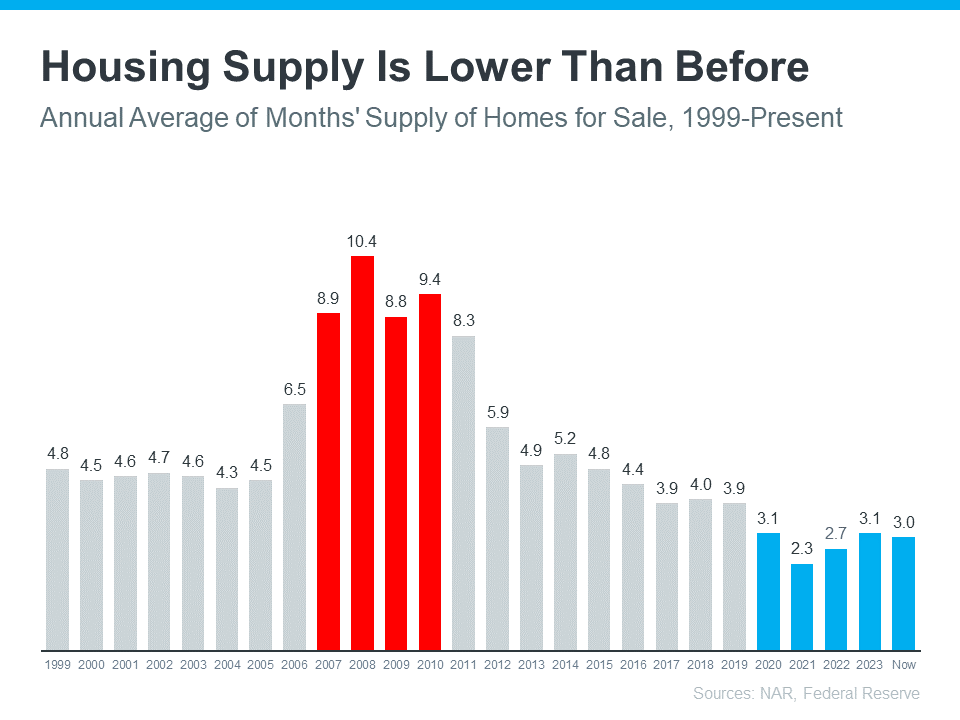

Because there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), that caused home prices to fall dramatically. But today, there’s an inventory shortage – not a surplus.

The graph below uses data from the National Association of Realtors (NAR) and the Federal Reserve to show how the months’ supply of homes available now (shown in blue) compares to the crash (shown in red):

Today, unsold inventory sits at just a 3.0-months’ supply. That’s compared to the peak of 10.4 month’s supply back in 2008. That means there’s nowhere near enough inventory on the market for home prices to come crashing down like they did back then.

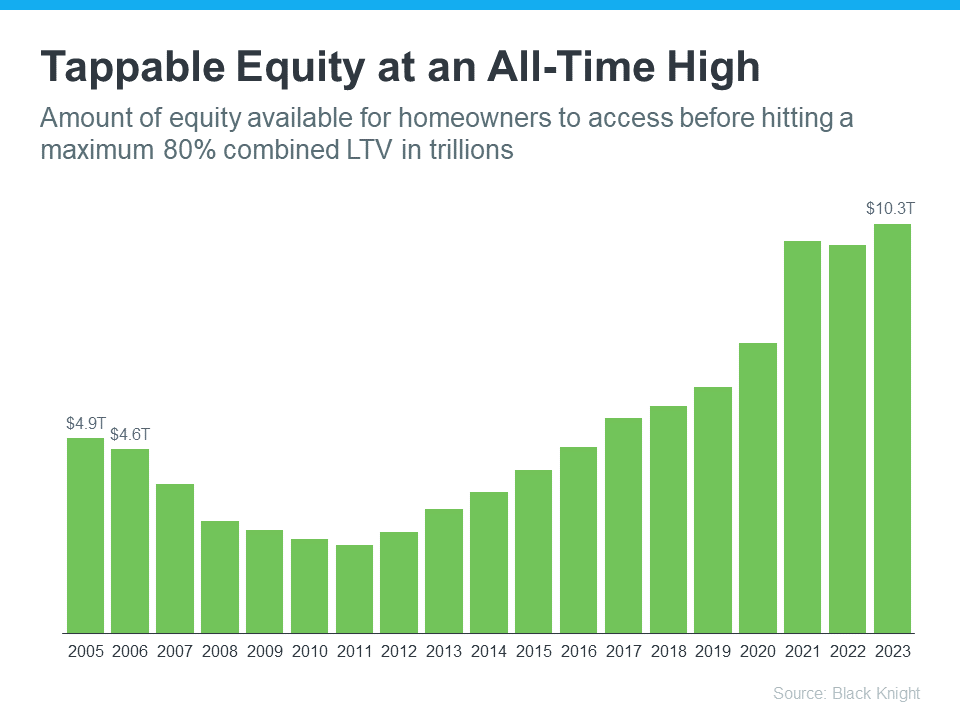

People Are Not Using Their Homes as ATMs Like They Did in the Early 2000s

Back in the lead up to the housing crash, many homeowners were borrowing against the equity in their homes to finance new cars, boats, and vacations. So, when prices started to fall, as inventory rose too high, many of those homeowners found themselves underwater.

But today, homeowners are a lot more cautious. Even though prices have skyrocketed in the past few years, homeowners aren’t tapping into their equity the way they did back then.

Black Knight reports that tappable equity (the amount of equity available for homeowners to access before hitting a maximum 80% loan-to-value ratio, or LTV) has actually reached an all-time high:

That means, as a whole, homeowners have more equity available than ever before. And that’s great. Homeowners are in a much stronger position today than in the early 2000s. That same report from Black Knight goes on to explain:

“Only 1.1% of mortgage holders (582K) ended the year underwater, down from 1.5% (807K) at this time last year.”

And since homeowners are on more solid footing today, they’ll have options to avoid foreclosure. That limits the number of distressed properties coming onto the market. And without a flood of inventory, prices won’t come tumbling down.

Bottom Line

While you may be hoping for something that brings prices down, that’s not what the data tells us is going to happen. The most current research clearly shows that today’s market is nothing like it was last time.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

by John Nyiszter | Nov 7, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

New Jersey Housing Market Update: A Lucrative Opportunity

The real estate market in New Jersey has been a topic of avid discussion lately. Investors, homeowners, and prospective buyers are all keen to understand the current trends and potential opportunities. In this housing market update, we will delve into the dynamic landscape of New Jersey’s real estate market, providing you with insights and valuable information you need to make informed decisions.

Booming Real Estate in the Garden State

New Jersey’s real estate market has been experiencing substantial growth, making it a prime location for both investors and homebuyers. The Garden State offers a unique blend of urban conveniences and natural beauty, which has contributed to its real estate resurgence.

Key Market Trends

Rising Demand

The demand for real estate in New Jersey is on the upswing. The proximity to major cities like New York and Philadelphia makes it an attractive location for those seeking a suburban lifestyle with easy access to urban centers.

Competitive Prices

While prices have been steadily rising, New Jersey still offers competitive rates when compared to neighboring cities. Savvy buyers can find excellent investment opportunities and affordable homes in the current market.

Diverse Neighborhoods

New Jersey boasts diverse neighborhoods, each with its unique charm and character. From the historical streets of Princeton to the beachfront properties along the Jersey Shore, there’s something for everyone.

Strong Rental Market

Investors have found New Jersey’s rental market to be particularly profitable. With a steady stream of tenants, rental properties are a viable option for generating consistent income.

Location Matters

When considering the New Jersey housing market, it’s crucial to pay attention to the specific areas within the state. Northern New Jersey offers a more urban experience, with proximity to New York City, while the southern part provides a more relaxed, coastal lifestyle.

Opportunities Await

Whether you’re a first-time homebuyer or an experienced investor, the New Jersey real estate market offers a wealth of opportunities. The current trends indicate a promising future for this state, making it an ideal time to explore the housing market.

In conclusion, New Jersey’s housing market is a thriving landscape with ample opportunities for individuals and investors alike. As demand continues to rise and competitive prices persist, it’s a wise choice to explore what the Garden State has to offer. With its diverse neighborhoods and strong rental market, New Jersey is poised to be a lucrative destination for those looking to make a real estate move.

John Nyiszter, Realtor with New & Modern Group LLC,

by John Nyiszter | Oct 23, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

Why Home Prices Keep Going Up

If you’ve ever dreamed of buying your own place, or selling your current house to upgrade, you’re no stranger to the rollercoaster of emotions changing home prices can stir up. It’s a tale of financial goals, doubts, and a dash of anxiety that many have been through.

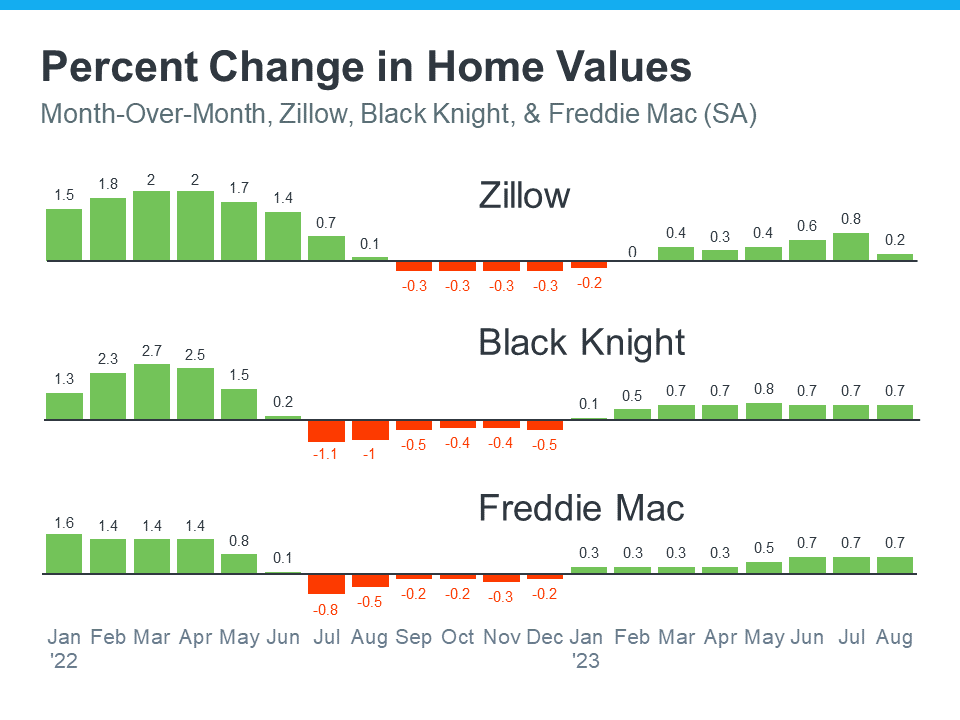

But if you put off moving because you’re worried home prices might drop, make no mistake, they’re not going down. In fact, it’s just the opposite. National data from several sources says they’ve been going up consistently this year (see graph below):

Here’s what this graph shows. In the first half of 2022, home prices rose significantly (the green bars on the left side of the graphs above). Those increases were dramatic and unsustainable.

So, in the second half of the year, prices went through a correction and started dipping a bit (shown in red). But those slight declines were shallow and short-lived. Still, the media really focused on those drops in their headlines – and that created a lot of fear and uncertainty among consumers.

But here’s what hasn’t been covered fully. So far in 2023, prices are going up once more, but this time at a more normal pace (the green bars on the right side of the graphs above). And after price gains that were too high and then the corrections that followed in 2022, the fact that all three reports show more normal or typical price appreciation this year is good news for the housing market.

Orphe Divounguy, Senior Economist at Zillow, explains changing home prices over the past 12 months this way:

“The U.S. housing market has surged over the past year after a temporary hiccup from July 2022-January 2023. . . . That downturn has proven to be short lived as housing has rebounded impressively so far in 2023. . .”

Looking ahead, home price appreciation typically starts to ease up this time of year. As that happens, there’s some risk the media will confuse slowing price growth (deceleration of appreciation) with home prices falling (depreciation). Don’t be fooled. Slower price growth is still growth.

Why Are Home Prices Increasing Now?

One reason why home prices are going back up is because there still aren’t enough homes for sale for all the people who want to buy them.

Even though higher mortgage rates cause buyer demand to moderate, they also cause the supply of available homes to go down. That’s because of the mortgage rate lock-in effect. When rates rise, some homeowners are reluctant to sell and lose their current low mortgage rate just to take on a higher one for their next home.

So, with higher mortgage rates impacting both buyers and sellers, the supply and demand equation of the housing market has been affected. But since there are still more people who want to purchase homes than there are homes available to buy, prices continue to rise. As Freddie Mac states:

“While rising interest rates have reduced affordability—and therefore demand—they have also reduced supply through the mortgage rate lock-in effect. Overall, it appears the reduction in supply has outweighed the decrease in demand, thus house prices have started to increase . . .”

Here’s How This Impacts You

- Buyers: If you’ve been waiting to buy a home because you were afraid its value might drop, knowing that home prices have gone back up should make you feel better. Buying a home gives you a chance to own something that usually becomes more valuable over time.

- Sellers: If you’ve been holding off on selling your house because you were worried about how changing home prices would impact its value, it could be a smart move to work with a real estate agent and put your house on the market. You don’t have to wait any longer because the most recent data indicates home prices have turned in your favor.

Bottom Line

If you put off moving because you were worried that home prices might go down, data shows they’re increasing across the country. Let’s connect so you can understand how home prices are changing in our local area.