by John Nyiszter | Sep 29, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners

The Many Non-Financial Benefits of Homeownership

Buying and owning your own home can have a big impact on your life. While there are financial reasons to become a homeowner, it’s essential to think about the non-financial benefits that make a home more than just a place to live.

Here are some of the top non-financial reasons to buy a home.

According to Fannie Mae, 94% of survey respondents say “Having Control Over What You Do with Your Living Space” is a top reason to own.

Your home is truly your own space. If you own a home, unless there are specific homeowner association requirements, you can decorate and change it the way you like. That means you can make small changes or even do big renovations to make your home perfect for you. Your home is uniquely yours and by buying, you give yourself the freedom to tailor it to your individual style. Investopedia explains:

“One often-cited benefit of homeownership is the knowledge that you own your little corner of the world. You can customize your house, remodel, paint, and decorate without the need to get permission from a landlord.”

When you rent, you might not be able to make your place really feel like it’s yours. And if you do make any modifications, you might have to change them back before you leave. But if you own your home, you can make it just the way you want it. That level of customization can give you a sense of pride in where you live and make you feel more connected to it.

Fannie Mae also finds 90% say “Having a Good Place for Your Family To Raise Your Children” tops their list of why it’s better to buy a home.

Another important factor to think about is what stage of life you’re in. U.S. News breaks it down:

“For those with young children, buying a home and putting down roots is a major driver. . . . You don’t want the upheaval of a massive rent increase or a non-renewed lease to impact your sense of stability.”

No matter which of life’s milestones you’re in, stability and predictability are important. That’s because the one constant in life is that things will change. And, as life changes around you, having a familiar home and not worrying about moving regularly helps you and those who matter most feel more secure and more comfortable.

Lastly, Fannie Mae says 82% list “Feeling Engaged in Your Community” as another key motivator to own.

Owning your home also helps you feel even more connected to your neighborhood. People who own homes usually live in them for an average of nine years, according to the National Association of Realtors (NAR). As that time passes, it’s natural to make friends and build strong ties in the community. As Gary Acosta, CEO and Co-Founder at the National Association of Hispanic Real Estate Professionals (NAHREP), points out:

“Homeowners also tend to be more active in their local communities . . .”

When you care deeply about the people you live near, you’ll do what you can to contribute to your local area.

Bottom Line

Owning your home can make your life better by giving you a sense of accomplishment, pride, stability, and connectedness. If you’re thinking about becoming a homeowner and want to learn more, let’s connect.

by John Nyiszter | Sep 29, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners

Remote Work Is Changing How Some Buyers Search for Their Dream Homes

The way Americans work has changed in recent years, and remote work is at the forefront of this shift. Experts say it’ll continue to be popular for years to come and project that 36.2 million Americans will be working remotely by 2025. To give you some perspective, that’s a 417% increase compared to the pre-pandemic years when there were just 7 million remote workers.

If you’re in the market to buy a home and you work remotely either full or part-time, this trend is a game-changer. It can help you overcome some of today’s affordability and housing inventory challenges.

How Remote Work Helps with Affordability

Remote or hybrid work allows you to change how you approach your home search. Since you’re no longer commuting every day, you may not feel it’s as essential to live near your office. If you’re willing to move a bit further out in the suburbs instead of the city, you could open up your pool of affordable options. In a recent study, Fannie Mae explains:

“Home affordability may also be a reason why we saw an increase in remote workers’ willingness to relocate or live farther away from their workplace . . .”

If you’re thinking about moving, having this kind of location flexibility can boost your chances of finding a home that fits your budget. Work with your agent to cast a wider net that includes additional areas with a lower cost of living.

More Work Flexibility Means More Home Options

And as you broaden your search to include more affordable options, you may also find you have the chance to get more features for your money too. Given the low supply of homes for sale, finding a home that fits all your wants and needs can be challenging.

By opening up your search, you’ll give yourself a bigger pool of options to choose from, and that makes it easier to find a home that truly fits your lifestyle. This could include homes with more square footage, diverse home styles, and a wider range of neighborhood amenities that were previously out of reach.

Historically, living close to work was a sought-after perk, often coming with a hefty price tag. But now, the dynamics have changed. If you work from home, you have the freedom to choose where you want to live without the burden of long daily commutes. This shift allows you to focus more on finding a home that is affordable and delivers on your dream home features.

Bottom Line

Remote work goes beyond job flexibility. It’s a chance to broaden your horizons in your home search. Without being bound to a fixed location, you have the freedom to explore all of your options. Let’s connect to find out how this freedom can lead you to your ideal home.

by John Nyiszter | Sep 29, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners

Why Today’s Housing Inventory Shows a Crash Isn’t on the Horizon

You might remember the housing crash in 2008, even if you didn’t own a home at the time. If you’re worried there’s going to be a repeat of what happened back then, there’s good news – the housing market now is different from 2008.

One important reason is there aren’t enough homes for sale. That means there’s an undersupply, not an oversupply like the last time. For the market to crash, there would have to be too many houses for sale, but the data doesn’t show that happening.

Housing supply comes from three main sources:

- Homeowners deciding to sell their houses

- Newly built homes

- Distressed properties (foreclosures or short sales)

Here’s a closer look at today’s housing inventory to understand why this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

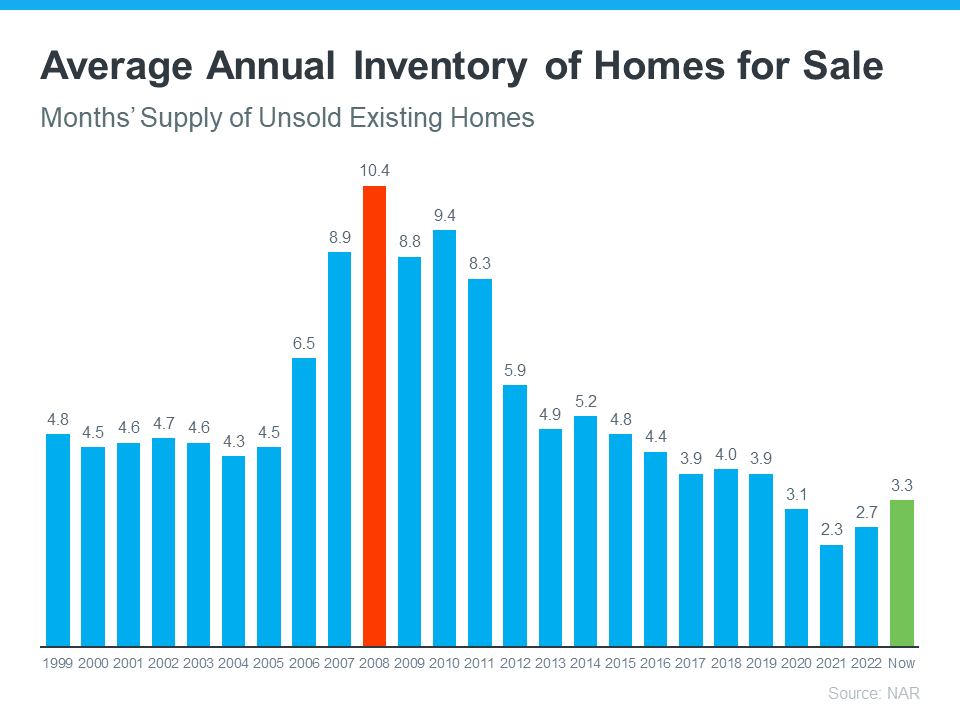

Although housing supply did grow compared to last year, it’s still low. The current months’ supply is below the norm. The graph below shows this more clearly. If you look at the latest data (shown in green), compared to 2008 (shown in red), there’s only about a third of that available inventory today.

So, what does this mean? There just aren’t enough homes available to make home values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that’s not happening right now.

Newly Built Homes

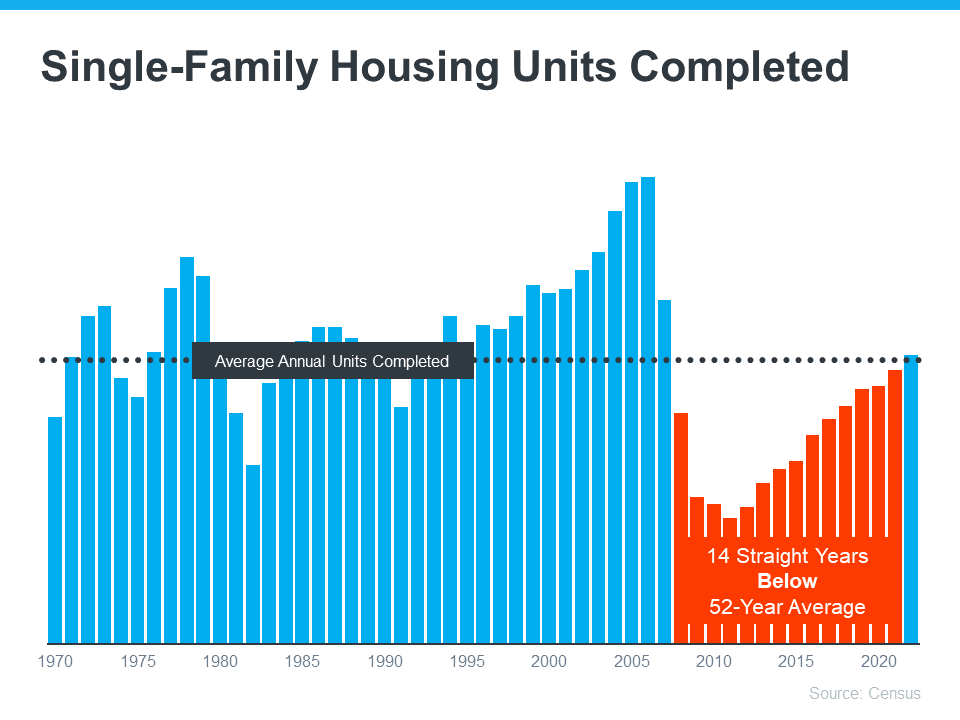

People are also talking a lot about what’s going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. The graph below shows the number of new houses built over the last 52 years:

The 14 years of underbuilding (shown in red) is a big part of the reason why inventory is so low today. Basically, builders haven’t been building enough homes for years now and that’s created a significant deficit in supply.

While the final blue bar on the graph shows that’s ramping up and is on pace to hit the long-term average again, it won’t suddenly create an oversupply. That’s because there’s too much of a gap to make up. Plus, builders are being intentional about not overbuilding homes like they did during the bubble.

Distressed Properties (Foreclosures and Short Sales)

The last place inventory can come from is distressed properties, including short sales and foreclosures. Back during the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

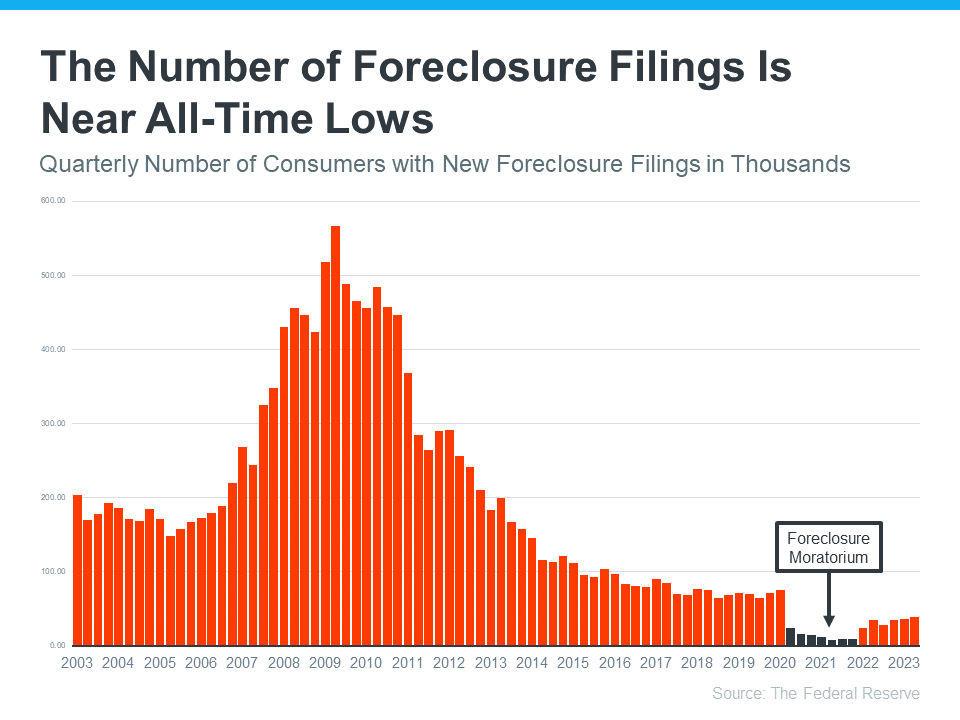

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from the Federal Reserve to show how things have changed since the housing crash:

This graph illustrates, as lending standards got tighter and buyers were more qualified, the number of foreclosures started to go down. And in 2020 and 2021, the combination of a moratorium on foreclosures and the forbearance program helped prevent a repeat of the wave of foreclosures we saw back around 2008.

The forbearance program was a game changer, giving homeowners options for things like loan deferrals and modifications they didn’t have before. And data on the success of that program shows four out of every five homeowners coming out of forbearance are either paid in full or have worked out a repayment plan to avoid foreclosure. These are a few of the biggest reasons there won’t be a wave of foreclosures coming to the market.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. According to Bankrate, that isn’t going to change anytime soon, especially considering buyer demand is still strong:

“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won’t allow a price crash in the near future.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis – and there’s nothing that suggests that will change anytime soon. That’s why housing inventory tells us there’s no crash on the horizon.

by John Nyiszter | Sep 29, 2023 | condos, First Time Home Buyers, investment properties, luxury homes

Beginning with Pre-Approval

If you’re looking to buy a home this fall, there are a few things you need to know. Affordability is tight with today’s mortgage rates and rising home prices. At the same time, there’s a limited number of homes on the market right now and that’s creating some competition among buyers. But, if you’re strategic, there are ways to navigate these waters. The first thing you’ll want to do is get pre-approved for a mortgage. That way you’ll know your numbers and can set yourself up for success from the start of your home search.

What Pre-Approval Does for You

To understand why it’s such an important step, you need to know what pre-approval is. As part of the homebuying process, a lender looks at your finances to determine what they’d be willing to loan you. From there, your lender will give you a pre-approval letter to help you know how much money you can borrow. Freddie Mac explains it like this:

“A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. . . . Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.”

Basically, pre-approval gives you critical information about the homebuying process that’ll help you understand how much you may be able to borrow. Why does this help you, especially today? With higher mortgage rates and home prices impacting affordability for many buyers right now, a solid understanding of your numbers is even more important so you can truly wrap your head around your options.

Pre-Approval Helps Show Sellers You’re a Serious Buyer

Let’s face it, there are more buyers looking to buy than there are homes available for sale and that imbalance is creating some competition among homebuyers. That means you could see yourself in a multiple-offer scenario when you make an offer on a home. But getting pre-approved for a mortgage can help you stand out from other hopeful buyers.

As an article from Wall Street Journal (WSJ) says:

“If you plan to use a mortgage for your home purchase, preapproval should be among the first steps in your search process. Not only can getting preapproved help you zero in on the right price range, but it can give you a leg up on other buyers, too.”

Pre-approval shows the seller you’re a serious buyer that’s already undergone a credit and financial check, making it more likely that the sale will move forward without unexpected delays or financial issues.

Bottom Line

Getting pre-approved is an important first step when you’re buying a home. The more prepared you are, the better chance you have of getting the home you want. Connect with a trusted lender so you have the tools you need to purchase a home in today’s market.

by John Nyiszter | Sep 29, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

The Return of Normal Seasonality for Home Price Appreciation

If you’re thinking of making a move, one of the biggest questions you have right now is probably: what’s happening with home prices? Despite what you may be hearing in the news, nationally, home prices aren’t falling. It’s just that price growth is beginning to normalize. Here’s the context you need to really understand that trend.

In the housing market, there are predictable ebbs and flows that happen each year. It’s called seasonality. Spring is the peak homebuying season when the market is most active. That activity is typically still strong in the summer but begins to wane as the cooler months approach. Home prices follow along with seasonality because prices appreciate most when something is in high demand.

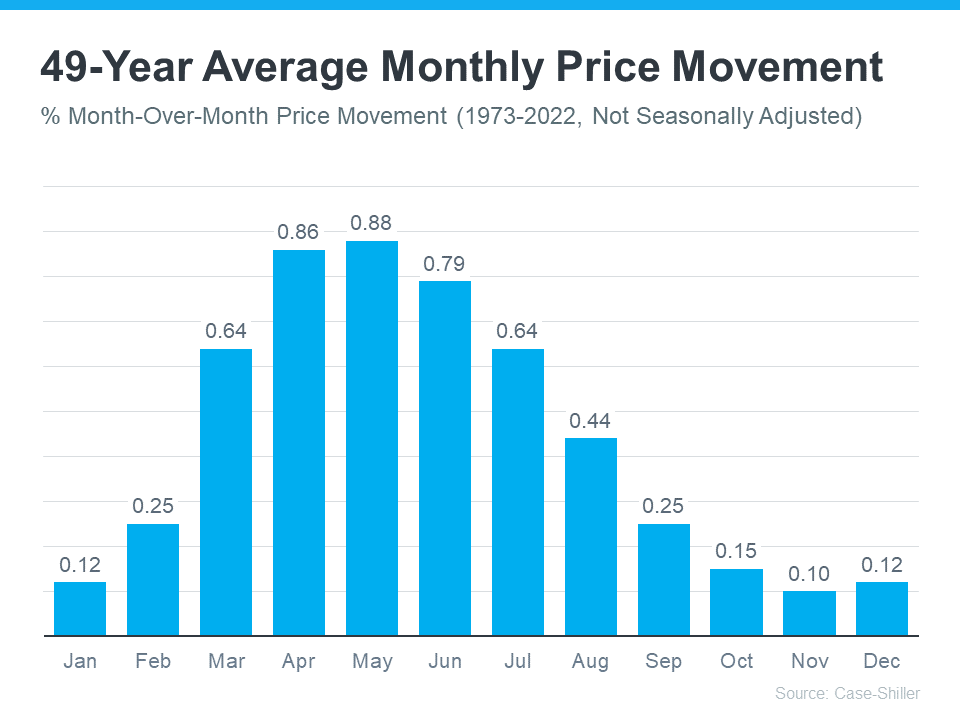

That’s why there’s a reliable long-term home price trend. The graph below uses data from Case-Shiller to show typical monthly home price movement from 1973 through 2022 (not adjusted, so you can see the seasonality):

As the data shows, at the beginning of the year, home prices grow, but not as much as they do in the spring and summer markets. That’s because the market is less active in January and February since fewer people move in the cooler months. As the market transitions into the peak homebuying season in the spring, activity ramps up, and home prices go up a lot more in response. Then, as fall and winter approach, activity eases again. Price growth slows, but still typically appreciates.

After several unusual ‘unicorn’ years, today’s higher mortgage rates helped usher in the first signs of the return of seasonality. As Selma Hepp, Chief Economist at CoreLogic, explains:

“High mortgage rates have slowed additional price surges, with monthly increases returning to regular seasonal averages. In other words, home prices are still growing but are in line with historic seasonal expectations.”

Why This Is So Important to Understand

In the coming months, you’re going to see the media talk more about home prices. In their coverage, you’ll likely see industry terms like these:

- Appreciation: when prices increase.

- Deceleration of appreciation: when prices continue to appreciate, but at a slower or more moderate pace.

- Depreciation: when prices decrease.

Don’t let the terminology confuse you or let any misleading headlines cause any unnecessary fear. The rapid pace of home price growth the market saw in recent years was unsustainable. It had to slow down at some point and that’s what we’re starting to see – deceleration of appreciation, not depreciation.

Remember, it’s normal to see home price growth slow down as the year goes on. And that definitely doesn’t mean home prices are falling. They’re just rising at a more moderate pace.

Bottom Line

While the headlines are generating fear and confusion on what’s happening with home prices, the truth is simple. Home price appreciation is returning to normal seasonality. If you have questions about what’s happening with prices in our local area, let’s connect.