by John Nyiszter | Jan 29, 2025 | condo owners, condos, First Time Home Buyers, FSBO, home buyers, Home Owners, Home Sellers, investment properties, luxury homes, property owners, townhome owners, Uncategorized

Two Resources That Can Help You Buy a Home Right Now

A recent report from Realtor.com says 20% of Americans don’t think homeownership is achievable. Maybe you feel the same way. With inflation driving up day-to-day expenses, saving enough to buy your first home is more of a challenge. But here’s the thing. With the right resources and help, you can still make it happen.

There are options that can help make buying a home possible today — even if your savings are limited or your credit isn’t perfect. Let’s explore just two of the solutions that could help get you into your first home no matter the market.

1. FHA Loans

If your down payment savings and your credit score aren’t where you want them to be, an FHA loan could be your pathway to buying a home. According to the U.S. Department of Housing and Urban Development (HUD) and Bankrate, the big perks of an FHA home loan are:

- Lower Down Payments: They typically require a smaller down payment than conventional loans, sometimes as low as 3.5% of the home’s purchase price.

- Lower Credit Score Requirements: They’re designed to help buyers with credit scores that might not qualify for conventional financing. This means, when conventional loans aren’t an option, you may still be able to get an FHA loan.

The first step is to connect with a lender who can help you explore your options and determine if you qualify.

2. Homeownership Assistance Programs

And if you need a more budget-friendly down payment, that’s not your only option. Did you know there are over 2,000 homeownership assistance programs available across the U.S. according to Down Payment Resource? And more than 75% of these programs are designed to help buyers with their down payment. Here’s a bit more information about why these could be such powerful tools for you:

- Financial Support: The average benefit for buyers who qualify for down payment assistance is $17,000. And that’s not a small number.

- Stackable Benefits: To make it even better, in some cases, you may be able to qualify for multiple programs at once, giving your down payment an even bigger boost.

Rob Chrane, CEO of Down Payment Resource confirms a little-known fact:

“Some of these programs can be layered. And so, in other words, you may not be limited to just one program.”

If you want to learn more or see what you qualify for, be sure to lean on the pros. A trusted real estate agent and a lender can guide you through the process, explain the help that’s out there, and connect you with resources to make buying a home a reality.

Bottom Line

If you’re ready to stop wondering if buying a home is possible and start exploring solutions, let’s connect.

by John Nyiszter | Jul 23, 2024 | condo owners, FSBO, Home Owners, Home Sellers, luxury homes, townhome owners

Why Fixing Up Your House Can Help It Sell Faster

If you’re thinking about selling your house, you should know there are buyers who are ready and able to pay today’s high prices. But they want a home that’s move-in ready. A recent press release from Redfin explains:

“Buyers are still out there and they’re willing to pay today’s high prices, but only if the house is in really good shape. They don’t want to spend extra money on paint or new appliances.”

It makes sense when you think about it. They’re having to pay a lot of money for a house in today’s market. That means they may not be able to easily afford upgrades after they move in. So, if your home is outdated or needs some work, buyers might pass it by or offer a lower price than you were hoping for.

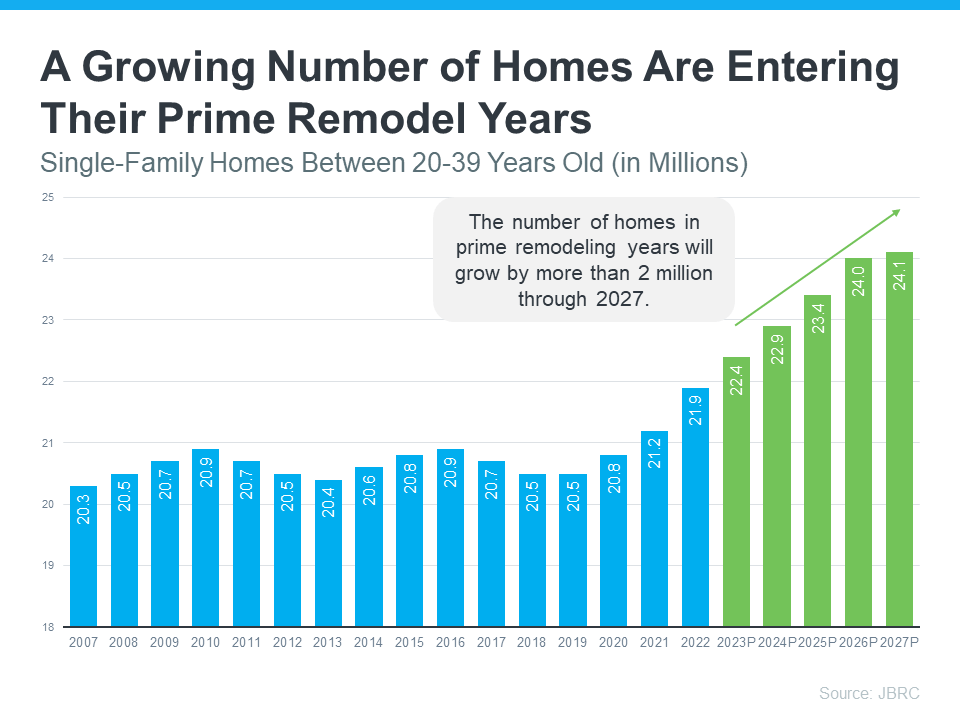

And there are a lot of homes that need upgrades right now. Millions are entering their prime remodel years, meaning they’re between 20 and 39 years old. Maybe yours is one of them. According to John Burns Research and Consulting (JBRC), the number of homes in their prime remodel years is high and growing (see graph below):

If your house falls into this category, it’s important to consider making selective updates to help it appeal to buyers, so it sells faster. But how do you know where to spend your time and money?

Why You Need a Real Estate Agent

By working with a local real estate agent to be strategic about the improvements you make, you can be sure you’re making a smart investment. Put simply, not all upgrades are worth the cost. As Bankrate says:

“Before you spend money on costly upgrades, be sure the changes you make will have a high return on investment. It doesn’t make sense to install new granite countertops, for example, if you only stand to break even on them, or even lose money.”

And, as that same Bankrate article goes on to say, that’s where a local real estate agent comes in:

“. . . a good real estate agent will know what local buyers expect and can help you decide what needs doing and what doesn’t.”

Your agent will know what buyers in your area are looking for and what they’re willing to pay for it. By working together, you can avoid spending money on upgrades that won’t pay off. Instead, they’ll fill you in on which changes will make your house more appealing and valuable.

Bottom Line

Selling a house right now requires more than just putting up a For Sale sign. You need to make sure it’s in good condition to attract buyers who are willing to pay today’s high prices.

The way to do that is by making smart improvements that will give you the best return on your investment. Let’s work together so you know what buyers are looking for and what your house needs before selling.

by John Nyiszter | Jul 23, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

Unlocking Homebuyer Opportunities in 2024

There’s no arguing this past year has been difficult for homebuyers. And if you’re someone who has started the process of searching for a home, maybe you put your search on hold because the challenges in today’s market felt like too much to tackle. You’re not alone in that. A Bright MLS study found some of the top reasons buyers paused their search in late 2023 and early 2024 were:

- They couldn’t find anything in their price range

- They didn’t have any successful offers or had difficulty competing

- They couldn’t find the right home

If any of these sound like why you stopped looking, here’s what you need to know. The housing market is in a transition in the second half of 2024. Here are four reasons why this may be your chance to jump back in.

1. The Supply of Homes for Sale Is Growing

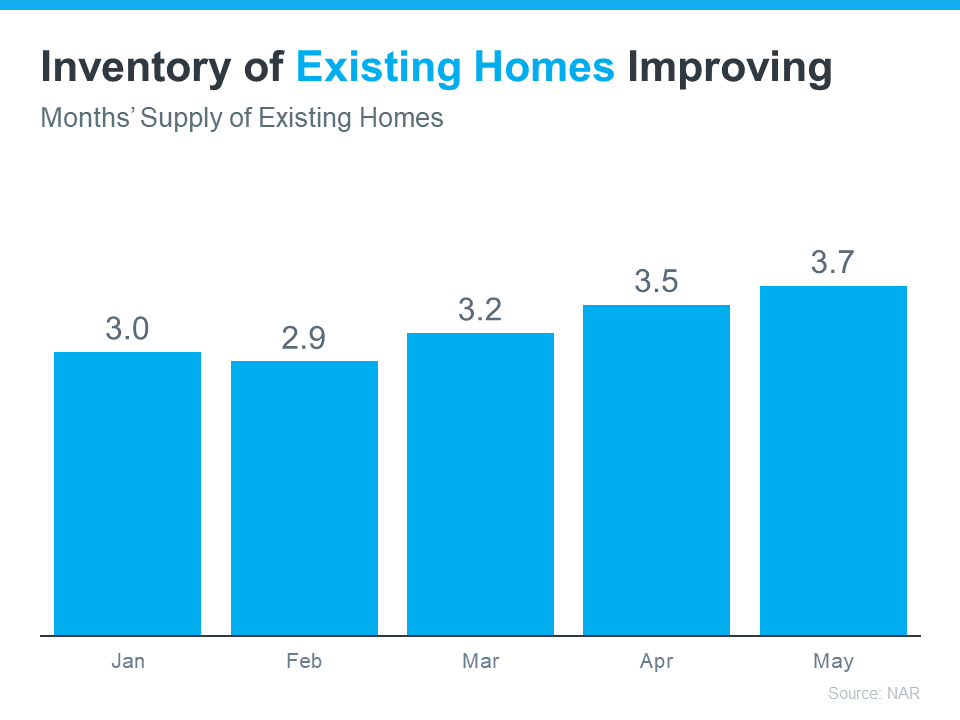

One of the most significant shifts in the market this year is how the months’ supply of homes for sale has increased. If you look at data from the National Association of Realtors (NAR), you’ll see how inventory has grown throughout 2024 (see graph below):

This graph shows the months’ supply of existing homes – homes that were previously lived in by another homeowner. The upward trend this year is clear.

This increase means you have a better chance of finding a home that suits your needs and preferences. And if the biggest reason you put off your home search was difficulty finding the right home, this is a big relief.

2. There’s More New Home Construction

And if you still don’t see an existing home you like, another big opportunity lies in the rise of new home construction. Builders have worked to increase the supply of newly built homes this year. And they’ve turned their attention to crafting smaller, more affordable homes based on what’s most needed in today’s market. This helps address the long-standing issue of housing undersupply throughout the country, and those smaller homes also offset some of the affordability challenges you’re feeling today.

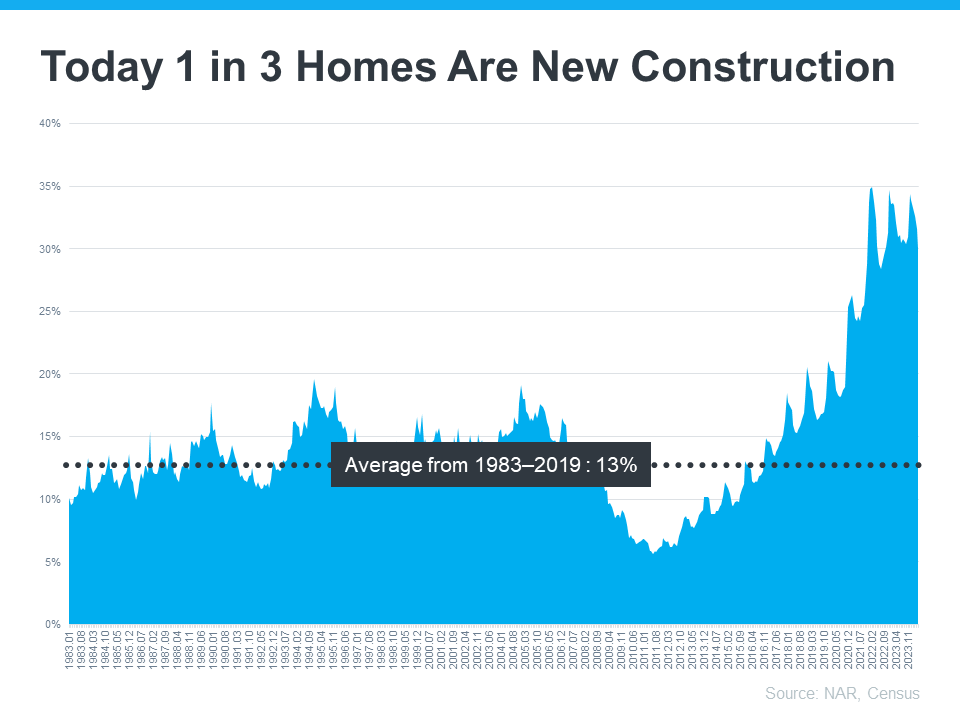

According to data from the Census and NAR, one in three homes on the market is a newly built home (see graph below):

This means, that if you didn’t previously look at newly built homes as part of your search, you may have been cutting your pool of options by a third. Not to mention, some builders are also offering incentives like buying down mortgage rates to make it easier for buyers to get a home that fits their budget.

So, consider talking to your agent about what builders have to offer in your area. Your agent’s expertise on builder reputations, contracts, and more will help you weigh your options.

3. Less Buyer Competition

Mortgage rates are still hovering around 7%, so buyer demand isn’t as fierce as it once was. And when you combine that with more housing supply, you have a better chance of avoiding an intense bidding war. Danielle Hale, Chief Economist at Realtor.com, highlights the positive trend for the latter half of 2024, saying:

“Home shoppers who persist could see better conditions in the second half of the year, which tends to be somewhat less competitive seasonally, and might be even more so since inventory is likely to reach five-year highs.”

This creates a unique opportunity for you to find a home you want to buy with less stress and at a potentially better price.

4. Home Prices Are Moderating

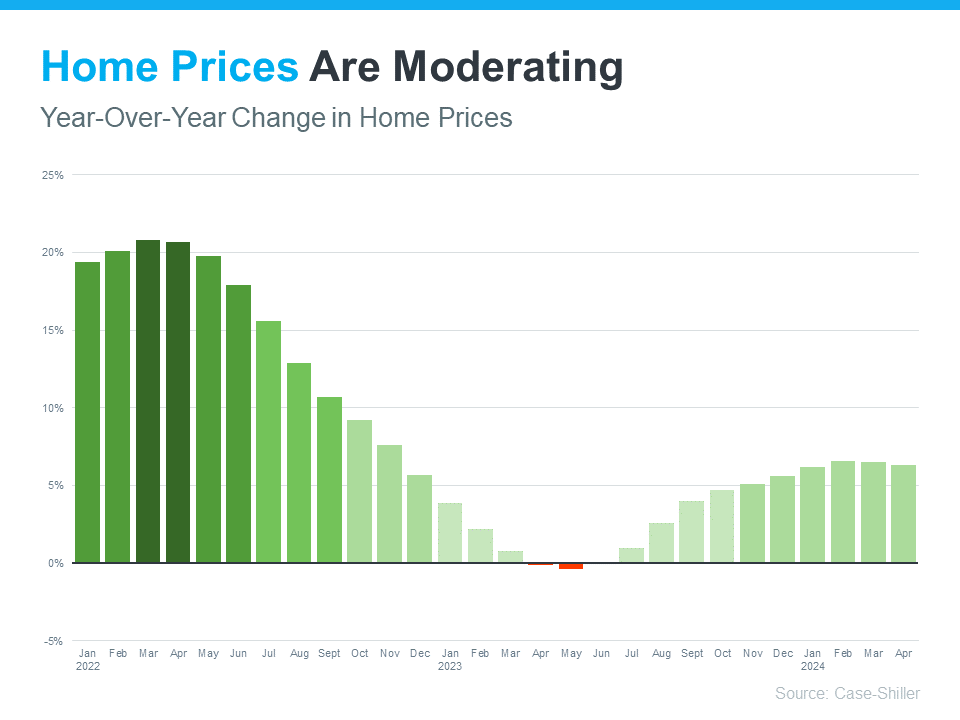

Speaking of prices, home prices are also showing signs of moderation – and that’s a welcome shift after the rapid appreciation seen in recent years (see graph below):

This moderation is mostly due to supply and demand. Supply is growing and demand is easing, so prices aren’t rising as fast. But make no mistake, that doesn’t mean prices are falling – they’re just rising at a more normal pace. You can see this in the graph. The bars are still showing prices increasing, just not as dramatic as it was before.

The average forecast for home price appreciation in 2024 is for positive growth around 3% to 5%, which is more in line with historical norms. That moderation means that you are less likely to face the steep price increases we saw a few years ago.

The Opportunity in Front of You

If you’re ready and able to buy, you may find that the second half of 2024 is a bit easier to navigate. There are still challenges, but some of the biggest hurdles you’ve faced are getting better as time wears on.

On the other hand, you could choose to wait. But if you do, here’s the risk you run. As more buyers recognize the shift in the market, competition will grow again. On a similar note, if mortgage rates do come down (as forecasts say), more buyers will flood back into the market. So, making a move now helps you take advantage of the current market conditions and get ahead of those other buyers.

Bottom Line

If you’ve put your dream of homeownership on hold, the second half of 2024 may be your chance to jump back in. Let’s connect to talk more about the opportunities you have in today’s market.

by John Nyiszter | Jul 23, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

How Affordability and Remote Work Are Changing Where People Live

There’s an interesting trend happening in the housing market. People are increasingly moving to more affordable areas, and remote or hybrid work is helping them do it.

Consider Moving to a More Affordable Area

Today’s high mortgage rates combined with continually rising home prices mean it’s tough for a lot of people to afford a home right now. That’s why many interested buyers are moving to places where homes are less expensive, and the cost of living is lower. As Orphe Divounguy, Senior Economist at Zillow, explains:

“Housing affordability has always mattered . . . and you’re seeing it across the country. Housing affordability is reshaping migration trends.”

If you’re hoping to buy a home soon, it might make sense to broaden your search area to include places where homes that fit your needs are more affordable. That’s what a lot of other people are doing right now to find a home within their budget. Extra Space Storage explains:

“55% of American adults are looking to relocate to a different state or city for more affordable homes and lower costs of living. . . Specifically, states with a strong economy, lower costs of living, and remote work options continue to be the ideal places to live in the U.S.”

Remote Work Opens Up More Home Options

If you work remotely or drive into the office only a few times each week, you have many more possibilities when looking for your next home. That’s because you can cast a broader net and include more suburban or rural areas nearby. As Market Place Homes says:

“People start to reconsider where they want to live when commute times are slashed in half or eliminated altogether. If they have a longer commute but don’t have to do it daily, they may feel like they can tolerate living farther away from their job. Or, if someone works entirely remotely, they can move to a cheaper area and get a lot of house for their dollar.”

How a Real Estate Agent Can Help

A real estate agent can help you find the perfect home for your budget. They’re especially valuable if you’re moving to a new, unfamiliar area. Bankrate says:

“If you’re moving far away, you may not have a good idea about which neighborhoods or towns will be the best fit. An experienced local agent can help you find the lifestyle you’re looking for in a home you can afford.”

So, if you’re thinking about relocating to somewhere with more affordable homes, what are you waiting for? With the added flexibility of remote work, you might have more options than before.

Bottom Line

Dreaming of a place where your money goes further? Let’s connect so you have someone to help you find your next home. Together, we’ll make your dream of homeownership a reality.

by John Nyiszter | Jul 23, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners

Why a Foreclosure Wave Isn’t on the Horizon

Even though data shows inflation is cooling, a lot of people are still feeling the pinch on their wallets. And those high costs on everything from gas to groceries are fueling unnecessary concerns that more people are going to have trouble making their mortgage payments. But, does that mean there’s a big wave of foreclosures coming?

Here’s a look at why the data and the experts say that’s not going to happen.

There Aren’t Many Homeowners Who Are Seriously Behind on Their Mortgages

One of the main reasons there were so many foreclosures during the last housing crash was because relaxed lending standards made it easy for people to take out mortgages, even when they couldn’t show they’d be able to pay them back. At that time, lenders weren’t being as strict when looking at applicant credit scores, income levels, employment status, and debt-to-income ratio.

But since then, lending standards have gotten a whole lot tighter. Lenders became much more diligent when assessing applicants for home loans. And that means we’re seeing more qualified buyers who have less of a risk of defaulting on their loans.

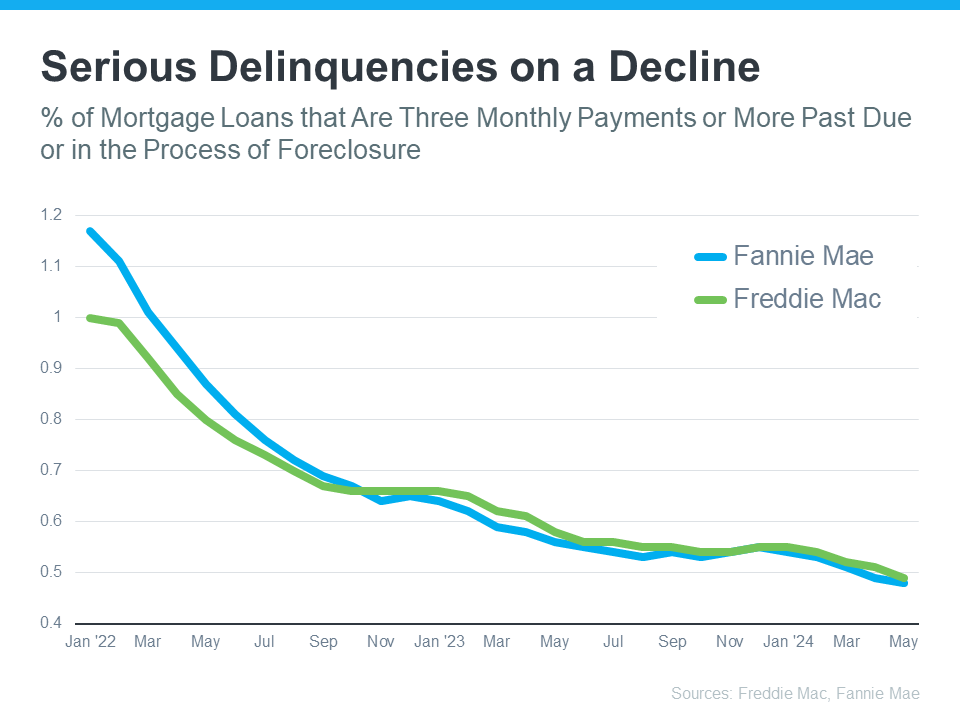

That’s why data from Freddie Mac and Fannie Mae shows the number of homeowners who are seriously behind on their mortgage payments (known in the industry as delinquencies) has been declining for quite some time. Take a look at the graph below:

What this means is that, not only are borrowers more qualified, but they’re also finding ways to navigate through their challenges, exploring their repayment options, or maybe even using the record amount of equity they have to sell and avoid foreclosure entirely.

The Answer Is: There’s No Sign of a Wave Coming

Before there can be a significant rise in foreclosures, the number of people who can’t make their mortgage payments would need to rise significantly. But, since so many buyers are making their payments today and homeowners have so much equity built up, a wave of foreclosures isn’t likely.

Take it from Bill McBride of Calculated Risk – an expert on the housing market who, after closely following the data and market leading up to the crash, was able to see the foreclosure crisis coming in 2008. McBride says:

“We will NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble) for two key reasons: 1) mortgage lending has been solid, and 2) most homeowners have substantial equity in their homes.”

Bottom Line

If you’re worried about a potential foreclosure crisis, know there’s nothing in the data to suggest that’ll happen. Buyers are more qualified now, and that’s one reason why they’re not falling seriously behind on their mortgage payments.

by John Nyiszter | Apr 8, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners

Don’t Let Your Student Loans Delay Your Homeownership Plans

If you have student loans and want to buy a home, you might have questions about how your debt affects your plans. Do you have to wait until you’ve paid off those loans before you can buy your first home? Or is it possible you could still qualify for a home loan even with that debt? Here’s a look at the latest information so you have the answers you need.

A Bankrate article explains:

“Roughly 60 percent of U.S. adults who have held student loan debt have put off making important financial decisions due to that debt . . . For Gen Z and millennial borrowers alone, that number rises to 70 percent.”

This includes one of the biggest financial decisions you’ll ever make, buying a home. But you should know, even with student loans, waiting to buy a home may not be necessary. While everyone’s situation is unique, your goal may be more within your reach than you realize. Here’s why.

Can You Qualify for a Home Loan if You Have Student Loans?

According to an annual report from the National Association of Realtors (NAR), 38% of first-time buyers had student loan debt and the typical amount was $30,000.

That means other people in a similar situation were able to qualify for and buy a home even though they also had student loans. And you may be able to do the same, especially if you have a steady source of income. As an article from Bankrate says:

“. . . you can have student loans and a mortgage at the same time. . . . If you have student loans and want a mortgage, there are multiple home loan programs you might qualify for . . .”

The key takeaway is, for many people, homeownership is achievable even with student loans.

You don’t have to figure this out on your own. The best way to make a decision about your goals and next steps is to talk to the professionals. A trusted lender can walk you through your options based on your situation, and share what’s worked for other buyers.

Bottom Line

Lots of other people with student loan debt are able to buy their own homes. Talk to a lender to go over your options and see how close you are to reaching your goal.

by John Nyiszter | Mar 29, 2024 | condo owners, condos, FSBO, Home Owners, Home Sellers, luxury homes, townhome owners

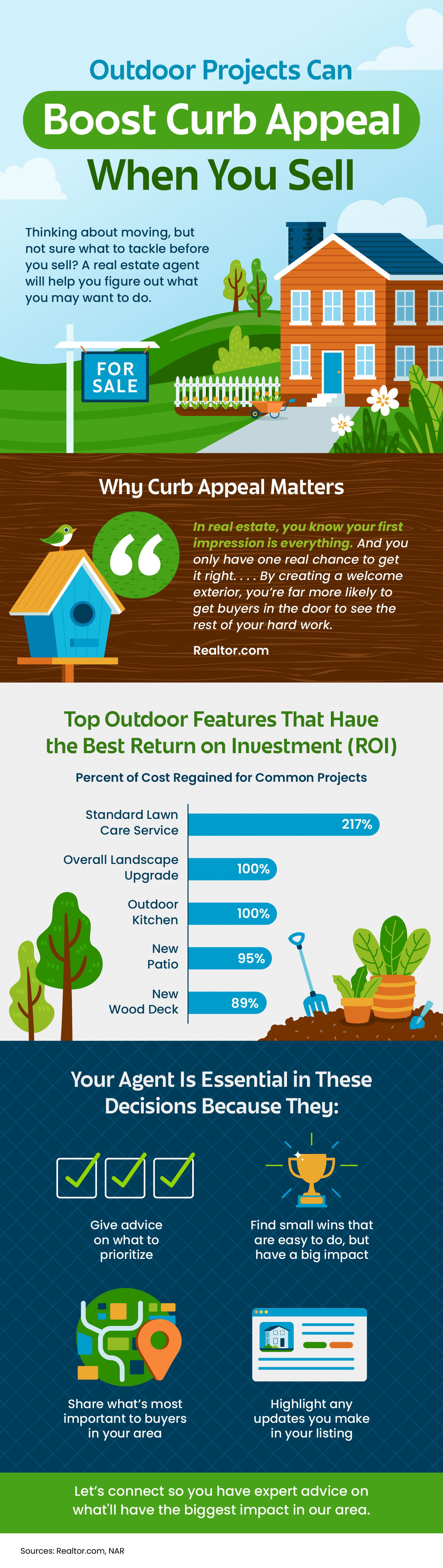

Outdoor Projects Can Boost Curb Appeal When You Sell [INFOGRAPHIC]

Some Highlights

- In real estate, a good first impression is key. If the outside of a house looks welcoming, more people will want to come in and see it.

- Your agent helps you by giving advice on what you may want to prioritize, finding easy fixes that make a big difference, knowing what buyers in your area like, and showing off your updates in your listing.

- Let’s connect so you have expert advice on what’ll have the biggest impact in our area.

by John Nyiszter | Mar 29, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

Is It Easier To Find a Home To Buy Now?

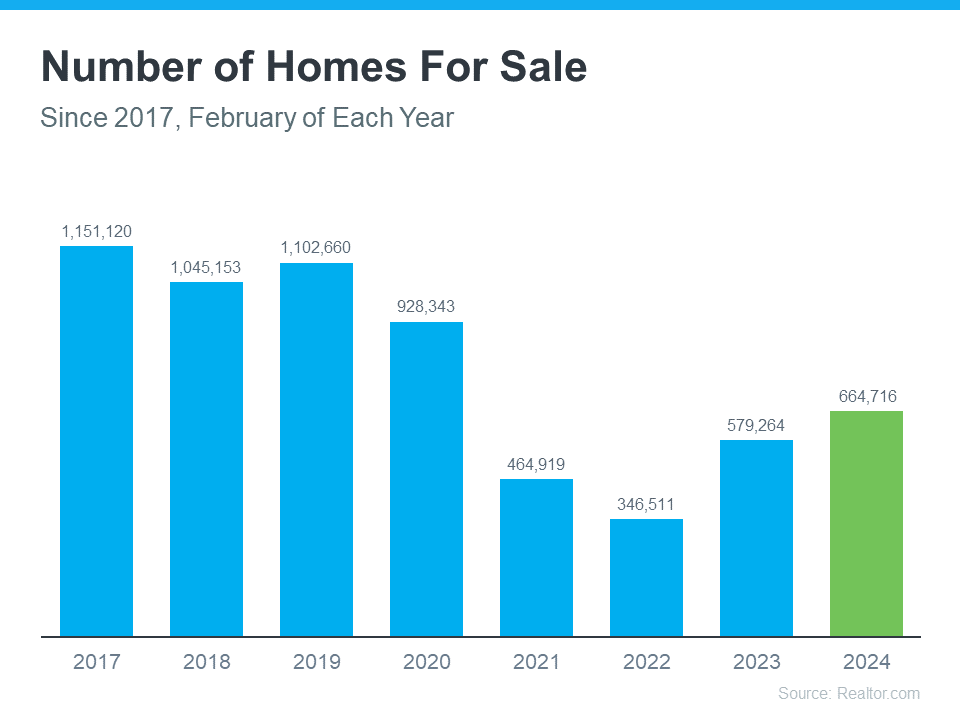

One of the biggest hurdles buyers have faced over the past few years has been a lack of homes available for sale. But that’s starting to change.

The graph below uses the latest data from Realtor.com to show there are more homes on the market in 2024 than there have been in any of the past several years (2021-2023):

Does That Mean Finding a Home Is Easier?

The answer is yes, and no. As an article from Realtor.com says:

“There were nearly 15% more homes for sale in February than a year earlier . . . That alone could jolt the housing market a bit if more “For Sale” signs continue to appear. However, the nation is still suffering from a housing shortage even with all of that new inventory.”

Context is important. On the one hand, inventory is up over the past few years. That means you’ll likely have more options to choose from as you search for your next home.

But, at the same time, the graph above also shows there are still significantly fewer homes for sale than there would usually be in a more normal, pre-pandemic market. And that deficit isn’t going to be reversed overnight.

What Does This Mean for You?

You might find a few more choices now than in recent years, but you shouldn’t expect a ton of options.

To help you explore the growing list of choices you have now, team up with a local real estate agent you trust. They can really help you understand the inventory situation where you want to buy. That’s because real estate is local. An experienced agent can share some smart tips they’ve used to help other buyers in your area deal with ongoing low housing supply.

Bottom Line

If you’re thinking about buying a home, let’s team up. That way, you’ll be up to date on everything that could affect your move, including how many homes are for sale right now.

by John Nyiszter | Mar 29, 2024 | condos, First Time Home Buyers, Home Owners, Home Sellers, luxury homes, townhome owners

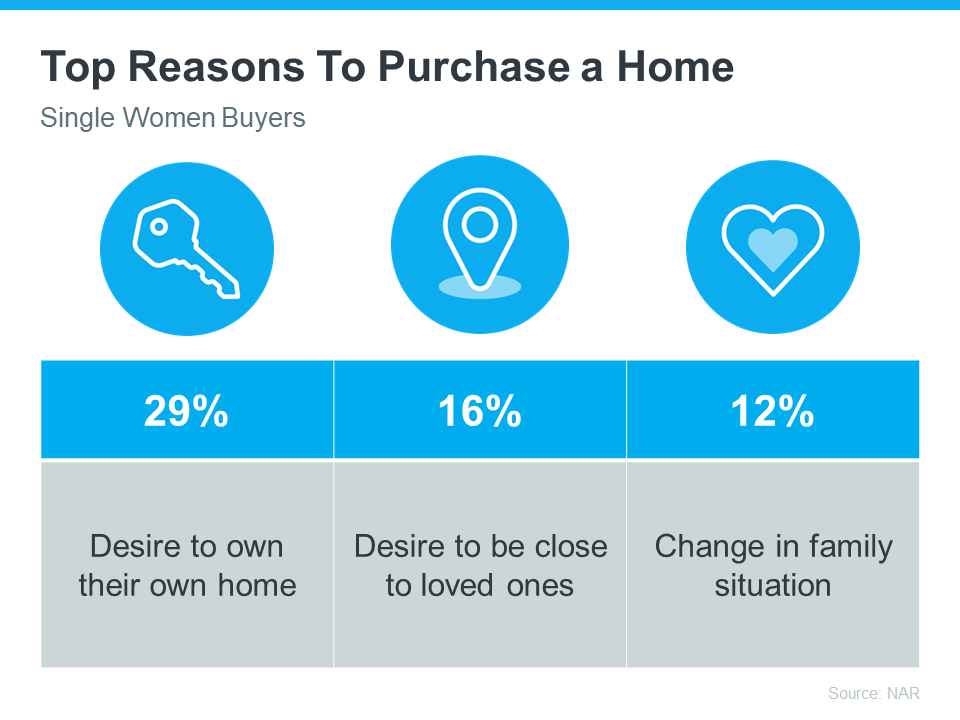

Single Women Are Embracing Homeownership

In today’s housing market, more and more single women are becoming homeowners. According to data from the National Association of Realtors (NAR), 19% of all homebuyers are single women, while only 10% are single men.

If you’re a single woman trying to buy your first home, this should be encouraging. It means other people are making their dreams a reality – so you can too.

Why Homeownership Matters to So Many Women

For many single women, buying a home isn’t just about having a place to live—it’s also a smart way to invest for the future. Homes usually increase in value over time, so they’re a great way to build equity and overall net worth. Ksenia Potapov, Economist at First American, says:

“. . . single women are increasingly pursuing homeownership and reaping its wealth creation benefits.”

The financial security and independence homeownership provides can be life-changing. And when you factor in the personal motivations behind buying a home, that impact becomes even clearer.

The same report from NAR shares the top reasons single women are buying a home right now, and the reality is, they’re not all financial (see chart below):

If any of these reasons resonate with you, maybe it’s time for you to buy too.

Work with a Trusted Real Estate Agent

If you’re a single woman looking to buy a home, it is possible, even in today’s housing market. You’ll just want to be sure you have a great real estate agent by your side.

Talk about what your goals are and why homeownership is so important to you. That way your agent can keep what’s critical for you up front as they guide you through the buying process. They’ll help you find the right home for your needs and advocate for you during negotiations. Together, you can make your dream of homeownership a reality.

Bottom Line

Homeownership is life-changing no matter who you are. Let’s connect today to talk about your goals in the housing market.

by John Nyiszter | Mar 26, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

What’s the Latest with Mortgage Rates?

Recent headlines may leave you wondering what’s next for mortgage rates. Maybe you’d previously heard there were going to be cuts this year that would bring rates down. That refers to the Federal Reserve (the Fed) and what they do to their Fed Funds Rate. While cutting, or lowering, the Fed Funds Rate doesn’t directly determine mortgage rates, it does tend to impact them. But when the Fed met last week, a cut didn’t happen — at least, not yet.

There are a lot of factors the Fed considered in their recent decision and most of them are complex. But you don’t need to be bogged down by those finer details. What you really want is the answer to this question: does that mean mortgage rates aren’t going to fall? Here’s what you need to know.

Mortgage Rates Are Still Expected To Drop This Year

While it hasn’t happened yet, that doesn’t mean it won’t. Even Jerome Powell, the Chairman of the Fed, says they still plan to make cuts this year, assuming inflation cools:

“We believe that our policy rate is likely at its peak for this tightening cycle and that, if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”

When this happens, history shows mortgage rates will likely follow. That means hope isn’t lost. As a recent article from Business Insider explains:

“As inflation comes down and the Fed is able to start lowering rates, mortgage rates should go down, too. . .”

What This Means for You

But you don’t necessarily want to wait for it to happen. Mortgage rates are notoriously hard to forecast. There are so many factors at play and any one of those can change the projections as the economy shifts. And it’s why the experts offer this advice. As Mark Fleming, Chief Economist at First American, says:

“Well, mortgage rate projections are just that, projections, not promises and don’t forget how hard it is to forecast them. . . So my advice is to never try to time the market . . . If one is financially prepared and buying a home aligns with your lifestyle goals, then it could be the right time to purchase. And there’s always the refinance option if mortgage rates are lower in the future.”

Basically, if you’re looking to move and trying to time the market, don’t. If you’re ready, willing, and able to move, it may still be worth it to do it now, especially if you can find the home you’ve been searching for.

Bottom Line

If you’re looking to buy a home, let’s connect so you have someone keeping you up-to-date on mortgage rates and helping you make the best decision possible.