by John Nyiszter | Sep 29, 2023 | condos, First Time Home Buyers, investment properties, luxury homes

Beginning with Pre-Approval

If you’re looking to buy a home this fall, there are a few things you need to know. Affordability is tight with today’s mortgage rates and rising home prices. At the same time, there’s a limited number of homes on the market right now and that’s creating some competition among buyers. But, if you’re strategic, there are ways to navigate these waters. The first thing you’ll want to do is get pre-approved for a mortgage. That way you’ll know your numbers and can set yourself up for success from the start of your home search.

What Pre-Approval Does for You

To understand why it’s such an important step, you need to know what pre-approval is. As part of the homebuying process, a lender looks at your finances to determine what they’d be willing to loan you. From there, your lender will give you a pre-approval letter to help you know how much money you can borrow. Freddie Mac explains it like this:

“A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. . . . Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.”

Basically, pre-approval gives you critical information about the homebuying process that’ll help you understand how much you may be able to borrow. Why does this help you, especially today? With higher mortgage rates and home prices impacting affordability for many buyers right now, a solid understanding of your numbers is even more important so you can truly wrap your head around your options.

Pre-Approval Helps Show Sellers You’re a Serious Buyer

Let’s face it, there are more buyers looking to buy than there are homes available for sale and that imbalance is creating some competition among homebuyers. That means you could see yourself in a multiple-offer scenario when you make an offer on a home. But getting pre-approved for a mortgage can help you stand out from other hopeful buyers.

As an article from Wall Street Journal (WSJ) says:

“If you plan to use a mortgage for your home purchase, preapproval should be among the first steps in your search process. Not only can getting preapproved help you zero in on the right price range, but it can give you a leg up on other buyers, too.”

Pre-approval shows the seller you’re a serious buyer that’s already undergone a credit and financial check, making it more likely that the sale will move forward without unexpected delays or financial issues.

Bottom Line

Getting pre-approved is an important first step when you’re buying a home. The more prepared you are, the better chance you have of getting the home you want. Connect with a trusted lender so you have the tools you need to purchase a home in today’s market.

by John Nyiszter | Sep 29, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

The Return of Normal Seasonality for Home Price Appreciation

If you’re thinking of making a move, one of the biggest questions you have right now is probably: what’s happening with home prices? Despite what you may be hearing in the news, nationally, home prices aren’t falling. It’s just that price growth is beginning to normalize. Here’s the context you need to really understand that trend.

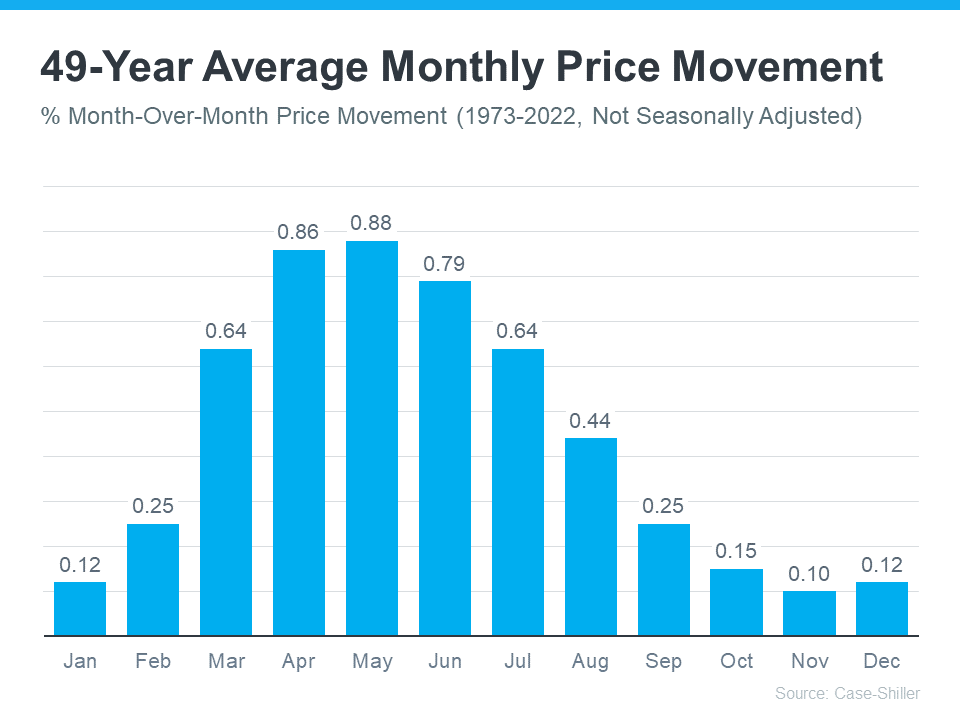

In the housing market, there are predictable ebbs and flows that happen each year. It’s called seasonality. Spring is the peak homebuying season when the market is most active. That activity is typically still strong in the summer but begins to wane as the cooler months approach. Home prices follow along with seasonality because prices appreciate most when something is in high demand.

That’s why there’s a reliable long-term home price trend. The graph below uses data from Case-Shiller to show typical monthly home price movement from 1973 through 2022 (not adjusted, so you can see the seasonality):

As the data shows, at the beginning of the year, home prices grow, but not as much as they do in the spring and summer markets. That’s because the market is less active in January and February since fewer people move in the cooler months. As the market transitions into the peak homebuying season in the spring, activity ramps up, and home prices go up a lot more in response. Then, as fall and winter approach, activity eases again. Price growth slows, but still typically appreciates.

After several unusual ‘unicorn’ years, today’s higher mortgage rates helped usher in the first signs of the return of seasonality. As Selma Hepp, Chief Economist at CoreLogic, explains:

“High mortgage rates have slowed additional price surges, with monthly increases returning to regular seasonal averages. In other words, home prices are still growing but are in line with historic seasonal expectations.”

Why This Is So Important to Understand

In the coming months, you’re going to see the media talk more about home prices. In their coverage, you’ll likely see industry terms like these:

- Appreciation: when prices increase.

- Deceleration of appreciation: when prices continue to appreciate, but at a slower or more moderate pace.

- Depreciation: when prices decrease.

Don’t let the terminology confuse you or let any misleading headlines cause any unnecessary fear. The rapid pace of home price growth the market saw in recent years was unsustainable. It had to slow down at some point and that’s what we’re starting to see – deceleration of appreciation, not depreciation.

Remember, it’s normal to see home price growth slow down as the year goes on. And that definitely doesn’t mean home prices are falling. They’re just rising at a more moderate pace.

Bottom Line

While the headlines are generating fear and confusion on what’s happening with home prices, the truth is simple. Home price appreciation is returning to normal seasonality. If you have questions about what’s happening with prices in our local area, let’s connect.

by John Nyiszter | Sep 29, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners

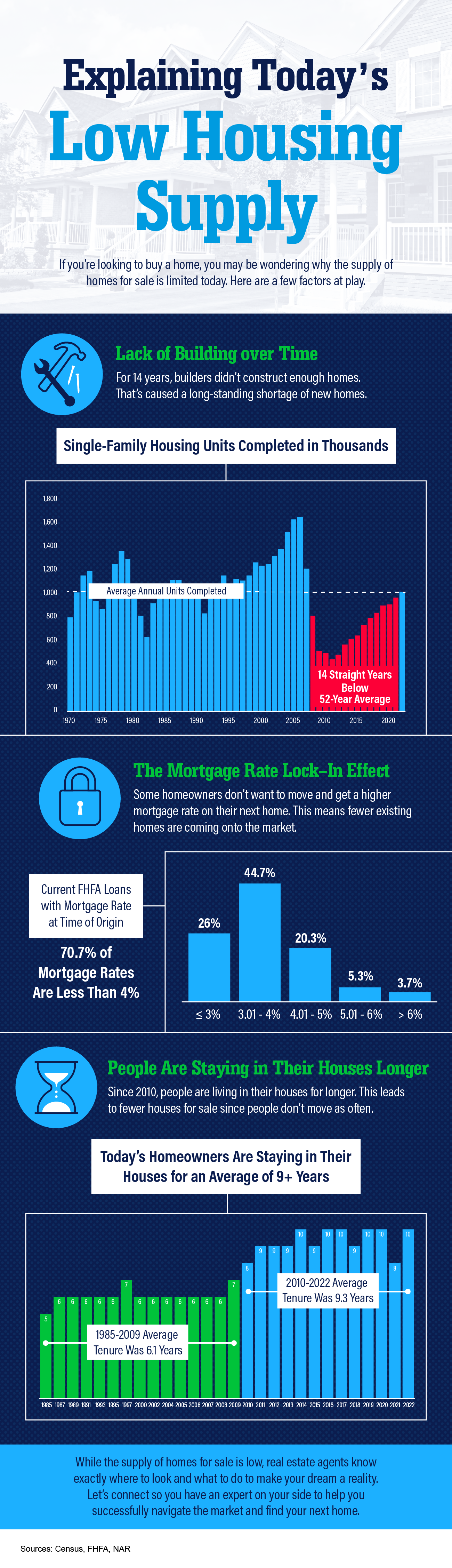

Explaining Today’s Low Housing Supply

Some Highlights

- Wondering why the supply of homes for sale is limited today? There are a few factors at play.

- Lack of building over time, the mortgage rate lock-in effect, and people staying in their houses longer are three of the main reasons why supply is low.

- But real estate agents know exactly where to look and what to do to make your dream a reality. Let’s connect so you have an expert on your side to help you successfully navigate the market and find your next home.

by John Nyiszter | May 23, 2023 | condo owners, First Time Home Buyers, Home Owners, investment properties, luxury homes, townhome owners

Why Buying a Vacation Home Beats Renting One This Summer

For many of us, visiting the same vacation spot every year is a summer tradition that’s fun, relaxing, and restful. If that sounds like you, now’s the time to think about your plans and determine if buying a vacation home this year makes more sense than renting one again. According to Forbes:

“. . . if the idea of vacationing at the same place every year makes you feel instantaneously relaxed, buying a vacation home might be a wise move.”

To help you decide if making a move like this is right for you, let’s explore why you may want to consider purchasing a vacation home today.

Benefits of Owning Your Vacation Home

You don’t have to worry about finding a place to stay. It can be a challenge to find a rental where you want, when you want. Some summer vacation destinations are more popular than others, meaning your favorite place may be booked up in advance. Bankrate explains why owning your vacation home means you don’t have to worry about that sort of inconvenience:

“. . . a second home can offer a place to have quality time with your family and ensures that you always have a vacation destination.”

It’s an investment. Home values typically appreciate over the long haul. That holds true for your vacation home as well, especially if it’s in an area with growing market demand. This can help grow your net worth with time.

Vacation homes may provide tax benefits. If you own a vacation home, you may be eligible for tax deductions based on where it is. However, before buying, you’ll want to consult with a tax professional to discuss first as taxes can vary by location.

It could potentially turn into a retirement location. If you love the location of your vacation home, you could potentially sell your primary residence and retire there in the future.

How a Pro Can Help You Find Your Perfect Match

As you’re preparing for summer vacation, remember, you could potentially visit your second home instead of another rental unit or hotel. If that sounds appealing to you, a

local real estate agent is your best resource. They have the knowledge and resources to help you understand the area and what vacation homes are available in your budget. Plus, these agents can explain the perks of how owning a second home can benefit you.

Bottom Line

If any of these reasons for owning a vacation home resonate with you, let’s connect. You still have time to enjoy spending the summer in your vacation home.

by John Nyiszter | May 4, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

How Homeowners Win When They Downsize

Downsizing has long been a popular option when homeowners reach retirement age. But there are plenty of other life changes that could make downsizing worthwhile. Homeowners who have experienced a change in their lives or no longer feel like their house fits their needs may benefit from downsizing too. U.S. News explains:

“Downsizing is somewhat common among older people and retirees who no longer have children living at home. But these days, younger people are also looking to downsize to save money on housing . . .”

And when inflation has made most things significantly more expensive, saving money where you can has a lot of appeal. So, if you’re thinking about ways to budget differently, it could be worthwhile to take your home into consideration.

When you think about cutting down on your spending, odds are you think of frequent purchases, like groceries and other goods. But when you downsize your house, you often end up downsizing the bills that come with it, like your mortgage payment, energy costs, and maintenance requirements. Realtor.com shares:

“A smaller home typically means lower bills and less upkeep. Then there’s the potential windfall that comes from selling your larger home and buying something smaller.”

That windfall is thanks to your home equity. If you’ve been in your house for a while, odds are you’ve developed a considerable amount of equity. Your home equity is an asset you can use to help you buy a home that better suits your needs today.

And when you’re ready to make a move, your team of real estate experts will be your guides through every step of the process. That includes setting the right price for your house when you sell, finding the best location and size for your next home, and understanding what you can afford at today’s mortgage rate.

What This Means for You

If you’re thinking about downsizing, ask yourself these questions:

- Do the original reasons I bought my current house still stand, or have my needs changed since then?

- Do I really need and want the space I have right now, or could somewhere smaller be a better fit?

- What are my housing expenses right now, and how much do I want to try to save by downsizing?

Once you know the answers to these questions, meet with a real estate advisor to get an answer to this one: What are my options in the market right now? A local housing market professional can walk you through how much equity you have in your house and how it positions you to win when you downsize.

Bottom Line

If you’re looking to save money, downsizing your home could be a great help toward your goal. Let’s connect to talk about your goals in the housing market this year.

by John Nyiszter | May 2, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners

What’s the Difference Between a Home Inspection and an Appraisal?

If you’re planning to buy a home, an inspection is an important step in the process. It assesses the condition of the home before you finalize the transaction. It’s also a different step in the process from an appraisal, which is a professional evaluation of the market value of the home you’d like to buy. In most cases, an appraisal is ordered by the lender to confirm or verify the value of the home prior to lending a buyer money for the purchase. Here’s the breakdown of each one and why they’re both important when buying a home.

Home Inspection

Here’s the key difference between an inspection and an appraisal. Bankrate says:

“In short, while an appraisal helps you understand a home’s value, inspections help you understand a home’s condition.”

The home inspection is a way to determine the current state, safety, and condition of the home before you finalize the sale. If anything is questionable in the inspection process – like the age of the roof, the state of the HVAC system, or just about anything else – you as a buyer have the option to discuss and negotiate any potential issues or repairs with the seller before the transaction is final. Your real estate agent is a key expert to help you through this part of the process.

Home Appraisal

The National Association of Realtors (NAR) explains:

“A home purchase is typically the largest investment someone will make. Protect yourself by getting your investment appraised! An appraiser will observe the property, analyze the data, and report their findings to their client. For the typical home purchase transaction, the lender usually orders the appraisal to assist in the lender’s decision to provide funds for a mortgage.”

When you apply for a mortgage, an unbiased appraisal (which is required by the lender) is the best way to confirm the value of the home based on the sale price. Regardless of what you’re willing to pay for a house, if you’ll be using a mortgage to fund your purchase, the appraisal will help make sure the bank doesn’t loan you more than what the home is worth.

This is especially critical in today’s sellers’ market where low inventory is driving an increase in bidding wars, which can push home prices upward. When sellers are in a strong position like this, they tend to believe they can set whatever price they want for their house under the assumption that competing buyers will be willing to pay more.

However, the lender will only allow the buyer to borrow based on the value of the home. This is what helps keep home prices in check. If there’s ever any confusion or discrepancy between the appraisal and the sale price, your trusted real estate professional will help you navigate any additional negotiations in the buying process.

Bottom Line

The inspection and the appraisal are critical steps when buying a home, and you don’t need to manage them by yourself. Let’s connect today so you have the expert guidance you need to navigate the entire homebuying process.