by John Nyiszter | May 2, 2023 | condos, First Time Home Buyers, investment properties, luxury homes

Why Buying a Home Makes More Sense Than Renting Today

Wondering if you should continue renting or if you should buy a home this year? If so, consider this. Rental affordability is still a challenge and has been for years. That’s because, historically, rents trend up over time. Data from the Census shows rents have been climbing pretty steadily since 1988.

And, data from the latest rental report from Realtor.com shows rents continue to grow today, even though it’s at a slower pace than we saw at the height of the pandemic:

“In March 2023, the U.S. rental market experienced single-digit growth for the eighth month in a row . . . The median asking rent was $1,732, up by $15 from last month and down by $32 from the peak but is still $354 (25.7%) higher than the same time in 2019 (pre-pandemic).”

With rents much higher now than they were in more normal, pre-pandemic years, owning your home may be a better option, especially if the long-term trend of rents increasing each year continues. In contrast, homeowners with a fixed-rate mortgage can lock in a monthly mortgage payment for the duration of their loan (typically 15-30 years).

Owning a Home Could Be More Affordable if You Need More Space

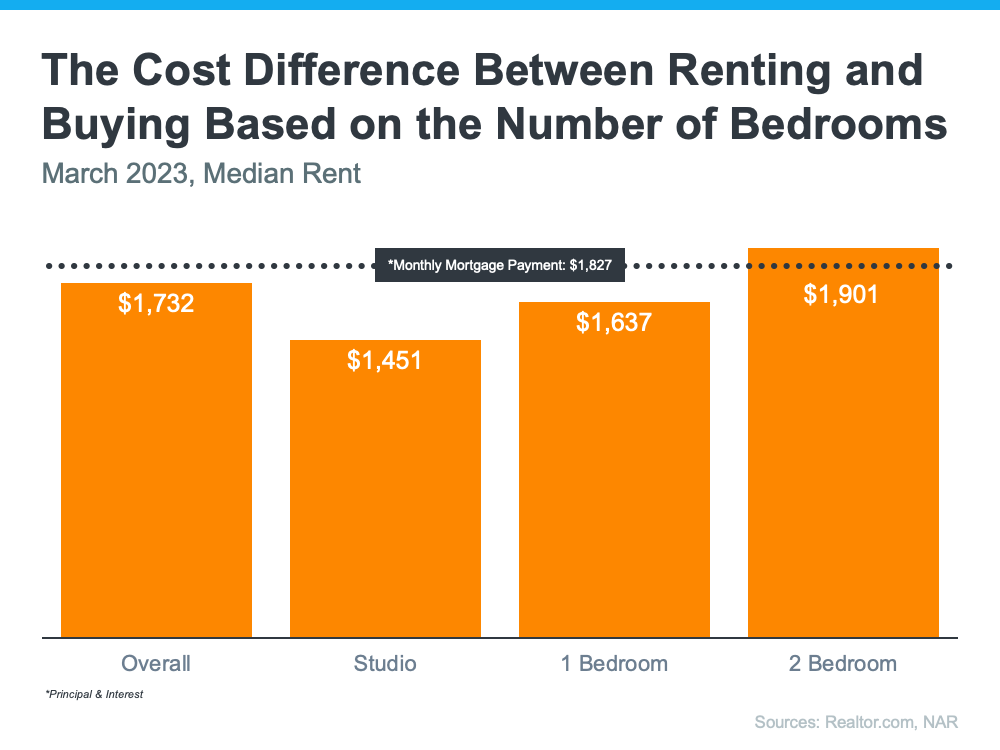

The graph below uses national data on the median rental payment from Realtor.com and median mortgage payment from the National Association of Realtors (NAR) to compare the two options. As the graph shows, depending on how much space you need, it’s typically more affordable to own than to rent if you need two or more bedrooms:

So, if you’re looking to live somewhere where you have two or more bedrooms to accommodate your household, give you more breathing room to spread out your belongings, or dedicate the extra space to practice your hobbies, it might make sense to consider homeownership.

Homeownership Allows You To Start Building Equity

In addition to shielding you from rising rents and being more affordable when you need more space, owning your home also allows you to start building your own equity, which in turn grows your net worth.

And, as home values typically rise over time and you pay off your mortgage, you build equity. That equity can set you up for success later on because you can use it to help fuel a move to an even bigger space down the line. That’s why, according to Zonda, the top reason millennial homeowners bought their home over the past year was to build their own equity instead of someone else’s.

Bottom Line

If you’re trying to decide whether to buy a home or continue renting, let’s connect to explore your options. With rents rising, it may make more sense to pursue your dream of homeownership.

by John Nyiszter | May 2, 2023 | condo owners, condos, First Time Home Buyers, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners

A Recession Doesn’t Equal a Housing Crisis

Everywhere you look, people are talking about a potential recession. And if you’re planning to buy or sell a house, this may leave you wondering if your plans are still a wise move. To help ease your mind, experts are saying that if we do officially enter a recession, it’ll be mild and short. As the Federal Reserve explained in their March meeting:

“. . . the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.”

While a recession may be on the horizon, it won’t be one for the housing market record books like the crash in 2008. What we have to remember is that a recession doesn’t always lead to a housing crisis.

To prove it, let’s look at the historical data of what happened in real estate during previous recessions. That way you know why you shouldn’t be afraid of what a recession could mean for the housing market today.

A Recession Doesn’t Mean Falling Home Prices

To show that home prices don’t fall every time there’s a recession, it helps to turn to historical data. As the graph below illustrates, looking at recessions going all the way back to 1980, home prices appreciated in four of the last six of them. So historically, when the economy slows down, it doesn’t mean home values will always fall.

Most people remember the housing crisis in 2008 (the larger of the two red bars in the graph above) and think another recession will be a repeat of what happened to housing then. But today’s housing market isn’t about to crash because the fundamentals of the market are different than they were in 2008. Back then, one of the big reasons why prices fell was because there was a surplus of homes for sale at the same time distressed properties flooded the market. Today, the number of homes for sale is low, so while home prices may see slight declines in some areas and slight gains in others, a crash simply isn’t in the cards.

A Recession Means Falling Mortgage Rates

What a recession really means for the housing market is falling mortgage rates. As the graph below shows, historically, each time the economy slowed down, mortgage rates decreased.

Bankrate explains mortgage rates typically fall during an economic slowdown:

“During a traditional recession, the Fed will usually lower interest rates. This creates an incentive for people to spend money and stimulate the economy. It also typically leads to more affordable mortgage rates, which leads to more opportunity for homebuyers.”

This year, mortgage rates have been quite volatile as they’ve responded to high inflation. The 30-year fixed mortgage rate has hovered between roughly 6-7%, and that’s impacted affordability for many potential homebuyers.

But, if there is a recession, history tells us mortgage rates may fall below that threshold, even though the days of 3% are behind us.

Bottom Line

You don’t need to fear what a recession means for the housing market. If we do have a recession, experts say it will be mild and short, and history shows it also means mortgage rates go down.

by John Nyiszter | Apr 10, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners

Trying To Buy a Home? Hang in There.

We’re still in a sellers’ market. And if you’re looking to buy a home, that means you’re likely facing some unique challenges, like difficulty finding a home and volatile mortgage rates. But keep in mind, there are some benefits to being a buyer in today’s market that give you good reason to stick with your search. Here are a few of them.

Long-Term Benefits Outweigh Short-Term Challenges

Owning a home grows your net worth – and since building that wealth takes time, it makes sense to start as soon as you can. If you wait to buy and keep renting, you’ll miss out on those monthly housing payments going toward your home equity. Freddie Mac puts it this way:

“Homeownership not only builds a sense of pride and accomplishment, but it’s also an important step toward achieving long-term financial stability.”

The key there is long-term because the financial benefits homeownership provides, like home value appreciation and equity, grow over time. Those benefits are worth the short-term challenges today’s sellers’ market presents.

Mortgage Rates Are Constantly Changing

Mortgage rates have been hovering around 6.5% over the last several months. However, as Sam Khater, Chief Economist at Freddie Mac, notes, they’ve been coming down some recently:

“Economic uncertainty continues to bring mortgage rates down. Over the last several weeks, declining rates have brought borrowers back to the market . . .”

Lower mortgage rates improve your purchasing power when you buy, and that can help make homeownership more affordable. Hannah Jones, Economic Data Analyst at realtor.com, explains:

“As we move into the spring buying season, mortgage rates have ticked lower, a welcomed sign of progress towards affordability.”

The recent drop in mortgage rates is good news if you couldn’t afford to buy a home when they peaked.

Home Prices Will Increase

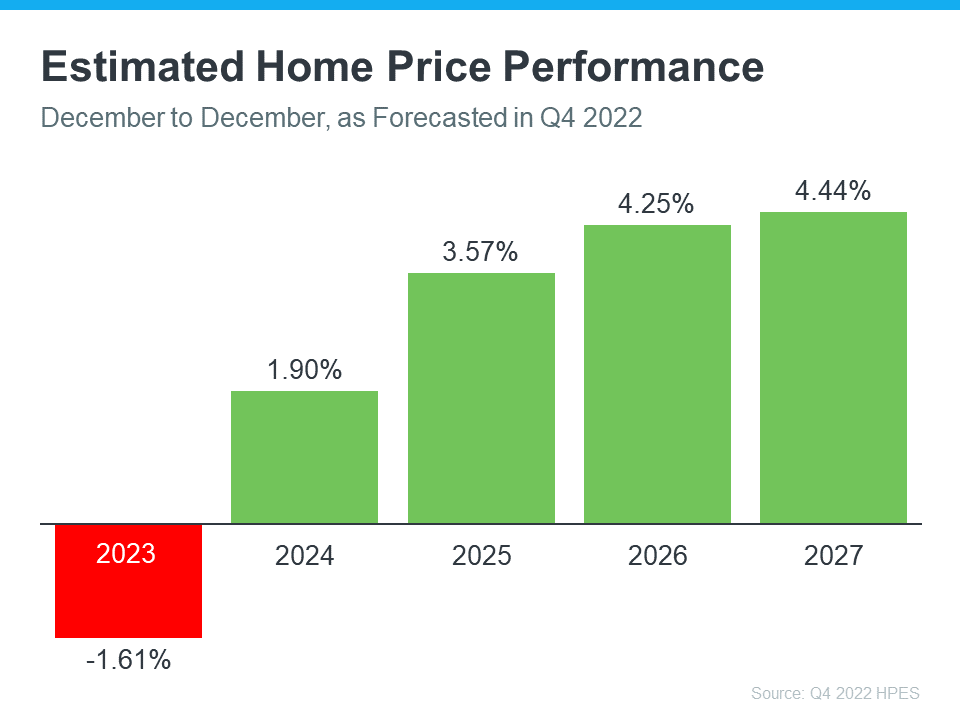

According to the Home Price Expectation Survey, which polls over 100 real estate experts, home values will go up steadily over the next few years after a slight decline this year (see graph below):

Rising home prices in the coming years means two things for you as a buyer:

- Waiting to buy a home could mean it’ll become more expensive to do so.

- Buying now means the value of your home, and your net worth, will likely grow over time.

Bottom Line

If you’ve been trying to buy a home, hang in there. Mortgage rates have ticked down some recently, home prices are forecast to increase in the coming years, and the long-term benefits of homeownership outweigh many of the short-term challenges.

by John Nyiszter | Apr 10, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners

Homebuyer Activity Shows Signs of Warming Up for Spring

The spring season appears to be warming up in housing as more and more buyers enter the market. And after rising mortgage rates sidelined so many buyers last year, that’s a good sign for sellers. Realtor.com has the latest:

“Spring is officially here, and like green shoots emerging from the bleak winter, new data suggests that more buyers are back in the market, although more subdued compared to a year ago.”

We know buyer activity is trending up because of mortgage purchase application data. According to Investopedia:

“A mortgage application is a document submitted to a lender when you apply for a mortgage to purchase real estate.”

That means the number of mortgage applications shows how many buyers are applying for mortgages. Put another way, an increase in mortgage applications means an increase in buyer demand – and as Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), explains, application activity started ramping up as mortgage rates fell steadily in March:

“Application activity increased as mortgage rates declined . . . recent increases, along with data from other sources showing an uptick in home sales, is a welcome development.”

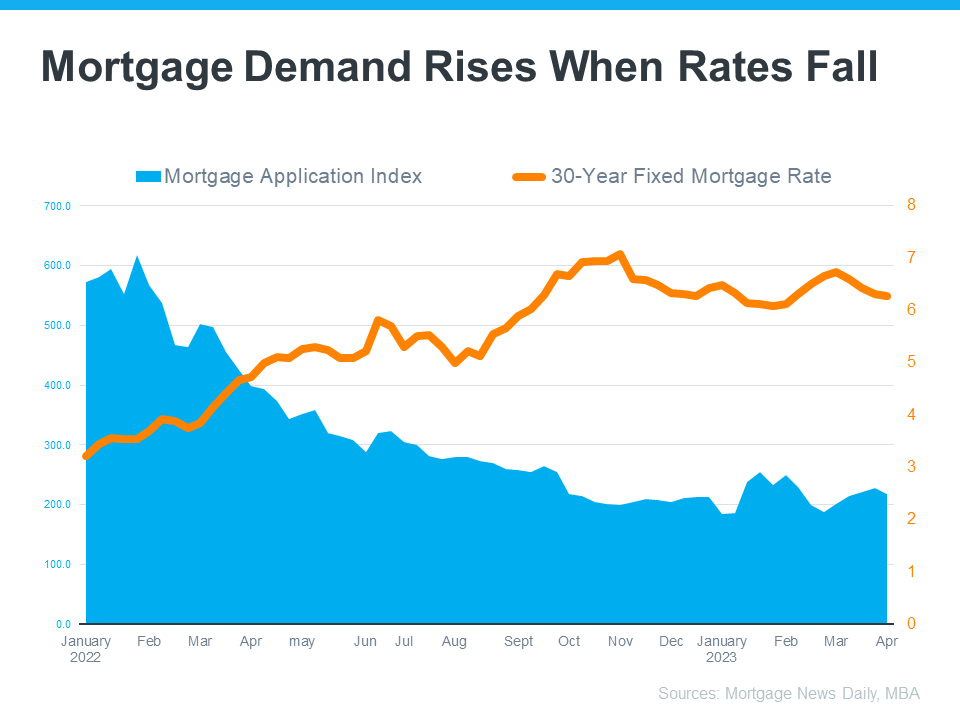

In fact, we can see how mortgage rates have a direct impact on applications over time. As rates rose dramatically last year, applications fell in response (see graph below):

The recent uptick in mortgage applications, as well as the decline in mortgage rates, is good news for sellers because it means more buyers are actively looking for homes.

What This Means for You

Buyers are coming this spring, which is typically the busiest time of the year in real estate. And as Realtor.com tells us, if you’re a seller, you need to prepare:

“If homeowners are planning to sell in 2023, now is the time to get ready.”

The means working with a local real estate agent to maximize your home’s appeal and get it listed at the ideal price for your area.

Bottom Line

The housing market is warming up for spring. If you’re thinking about selling your house and taking advantage of this recent uptick in buyer activity, let’s connect.

by John Nyiszter | Mar 30, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

We’re in a Sellers’ Market. What Does That Mean?

Even though activity in the housing market has slowed from the frenzy we saw over a year ago, today’s low supply of homes for sale is still a sellers’ market. But what does that really mean? And why are conditions today so good if you want to list your house?

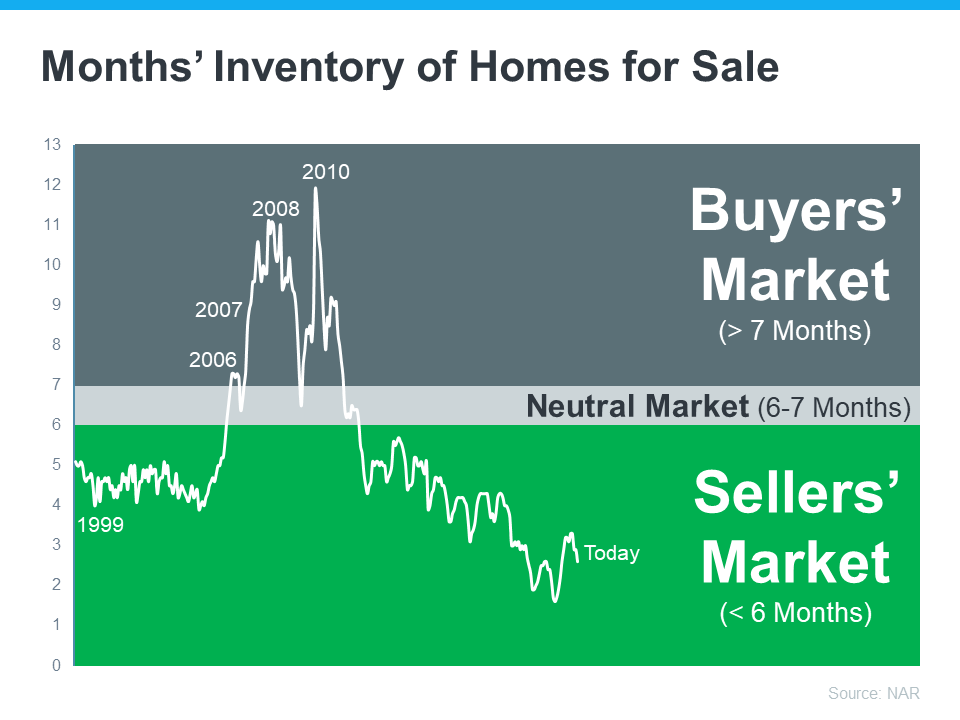

It starts with the number of homes available for sale. The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows housing supply is still astonishingly low. Today, we have a 2.6-month supply of homes at the current sales pace. Historically, a 6-month supply is necessary for a ‘normal’ or ‘neutral’ market in which there are enough homes available for active buyers (see graph below):

What Does This Mean for You?

When the supply of homes for sale is as low as it is right now, it’s much harder for buyers to find one to purchase. That creates increased competition among purchasers and keeps upward pressure on prices. And if buyers know they’re not the only one interested in a home, they’re going to do their best to submit a very attractive offer. As this happens, sellers are positioned to negotiate deals that meet their ideal terms. Lawrence Yun, Chief Economist at NAR, says:

“Inventory levels are still at historic lows. Consequently, multiple offers are returning on a good number of properties.”

Right now, there are still buyers who are ready, willing, and able to purchase a home. If you list your house right now in good condition and at the right price, it could get a lot of attention from competitive buyers.

Bottom Line

Today’s sellers’ market holds great opportunities for homeowners ready to make a move. Listing your house now will maximize your exposure to serious, competitive buyers. Let’s connect to discuss how to jumpstart the selling process.

by John Nyiszter | Feb 28, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

One Major Benefit of Investing in a Home

One of the many reasons to buy a home is that it’s a major way to build wealth and gain financial stability. According to Freddie Mac:

“Building equity through your monthly principal payments and appreciation is a critical part of homeownership that can help you create financial stability.”

With spring approaching, now’s a great time to consider if buying a home makes sense for you. The best way to figure that out is to talk with a trusted real estate professional.

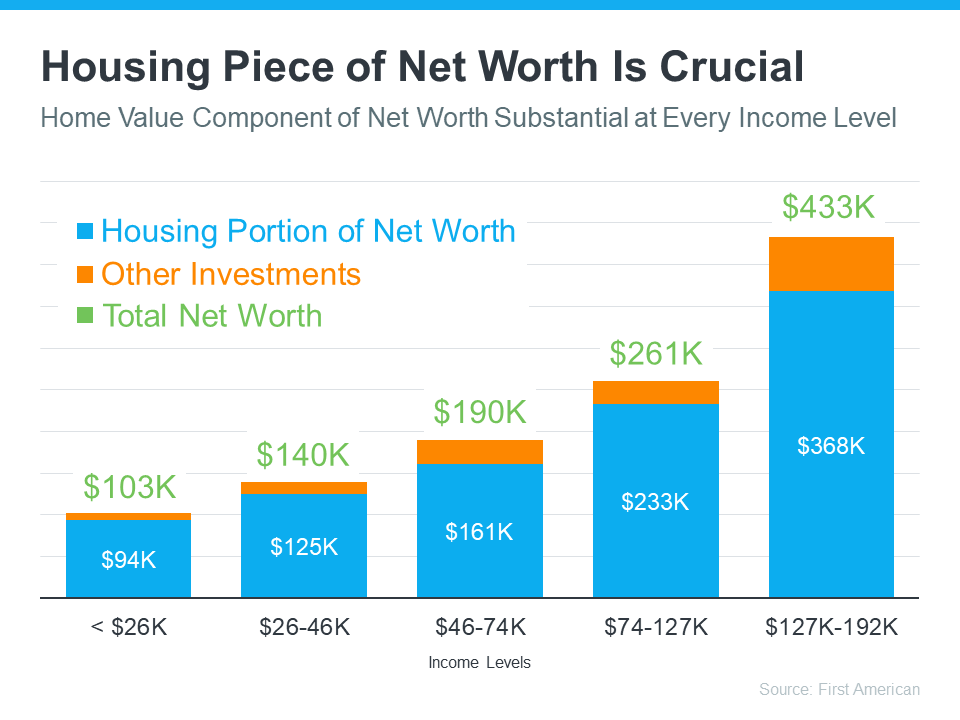

The Largest Part of Most Homeowners’ Net Worth Is Their Equity

You may be surprised to learn just how much of a homeowner’s net worth actually comes from owning their home. The National Association of Realtors (NAR) shares:

“Homeownership is the largest source of wealth among families, with the median value of a primary residence worth about ten times the median value of financial assets held by families. Housing wealth (home equity or net worth) gains are built up through price appreciation and by paying off the mortgage.”

In other words, home equity does more to build the average household’s wealth than anything else. And according to data from First American, this holds true across different income levels (see graph below):

Bottom Line

One of the biggest benefits of owning a home, regardless of your income level, is that it provides financial stability and an avenue to build wealth. Let’s connect today so you can start investing in homeownership.