by John Nyiszter | Mar 20, 2024 | condo owners, Home Owners, Home Sellers, townhome owners

Homeowners Today Have Options To Avoid Foreclosure

Even with the latest data coming in, the experts agree there’s no chance of a large-scale foreclosure crisis like the one we saw back in 2008. While headlines may be calling attention to a slight uptick in foreclosure filings recently, the bigger picture is that we’re still well below the number we’d see in a more normal year for the housing market. As a report from BlackKnight explains:

“The prospect of any kind of near-term surge in foreclosure activity remains low, with start volumes still nearly 40% below pre-pandemic levels.”

That’s good news. It means the number of homeowners at risk is very low compared to the norm.

But, there’s a small percentage who may be coming face to face with foreclosure as a possibility. That’s because some homeowners may have an unexpected hardship in their life, which unfortunately can happen in any market.

For those homeowners, there are still options that could help them avoid having to go through the foreclosure process. If you’re facing difficulties yourself, an article from Bankrate breaks down some things to explore:

- Look into Forbearance Programs: If you have a loan from Fannie Mae or Freddie Mac, you may be able to apply for this type of program.

- Ask for a loan modification: Your lender may be willing to adjust your loan terms to help bring down your monthly payment to something more achievable.

- Get a repayment plan in place: A lender may be able to set up a deferral or a payment plan if you’re not in a place where you’re able to make your payment.

And there’s something else you may want to consider. That’s whether you have enough equity in your home to sell it and protect your investment.

You May Be Able To Use Your Equity To Sell Your House

In today’s real estate market, many homeowners have far more equity in their homes than they realize due to the rapid home price appreciation we’ve seen over the past few years. That means, if you’ve lived in your house for a while, chances are your home’s value has gone up. Plus, the mortgage payments you’ve made during that time have chipped away at the balance of your loan. That combo may have given your equity a boost. And if your home’s current value is higher than what you still owe on your loan, you may be able to use that increase to your advantage. Freddie Mac explains how this can help:

“If you have enough equity, you can use the proceeds from the sale of your home to pay off your remaining mortgage debt, including any missed mortgage payments or other debts secured by your home.”

Lean on Experts To Explore Your Options

To find out how much equity you have, partner with a local real estate agent. They can give you an estimate of what your house could sell for based on recent sales of similar homes in your area. You may be able to sell your house to avoid foreclosure.

Bottom Line

If you’re a homeowner facing hardship, lean on a real estate professional to explore your options or see if you can sell your house to avoid foreclosure.

by John Nyiszter | Mar 4, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

There’s a lot of confusion in the market about what’s happening with day-to-day movement in mortgage rates right now, but here’s what you really need to know: compared to the near 8% peak last fall, mortgage rates have trended down overall.

And if you’re looking to buy or sell a home, this is a big deal. While they’re going to continue to bounce around a bit based on various economic drivers (like inflation and reactions to the consumer price index, or CPI), don’t let the short-term volatility distract you. The experts agree the overarching downward trend should continue this year.

While we won’t see the record-low rates homebuyers got during the pandemic, some experts think we should see rates dip below 6% later this year. As Dean Baker, Senior Economist, Center for Economic Research, says:

“They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.”

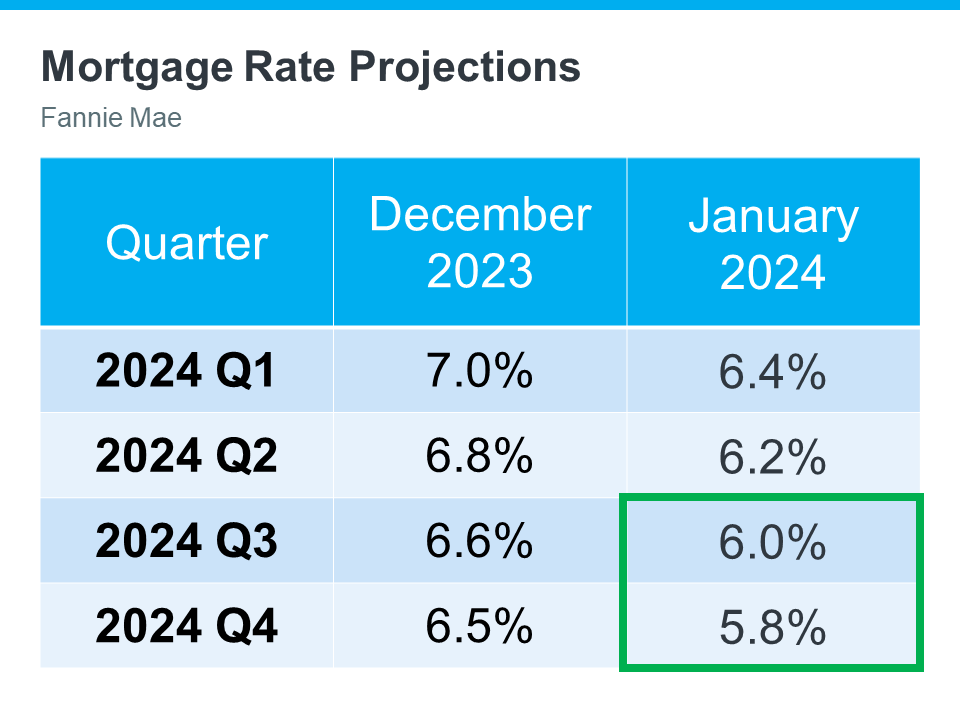

And Baker isn’t the only one saying this is a possibility. The latest Fannie Mae projections also indicate we may see a rate below 6% by the end of this year (see the green box in the chart below):

The chart shows mortgage rate projections for 2024 from Fannie Mae. It includes the one that came out in December, and compares it to the updated 2024 forecast they released just one month later. And if you look closely, you’ll notice the projections are on the way down.

It’s normal for experts to re-forecast as they watch current market trends and the broader economy, but what this shows is experts are feeling confident rates should continue to decline, if inflation cools.

What This Means for You

But remember, no one can say for sure what will happen (and by when) – and short-term volatility is to be expected. So, don’t let small fluctuations scare you. Focus on the bigger picture.

If you’ve found a home you love in today’s market – especially where finding a home that meets your budget and your needs can be a challenge – it’s probably not a good idea to try to time the market and wait until rates drop below 6%.

With rates already lower than they were last fall, you have an opportunity in front of you right now. That’s because even a small quarter point dip in rates gives your purchasing power a boost.

Bottom Line

If you wanted to move last year but were holding off hoping rates would fall, now may be the time to act. Let’s connect to get the ball rolling.

by John Nyiszter | Mar 4, 2024 | condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

If you’re planning to buy your first home, saving up for all the costs involved can feel daunting, especially when it comes to the down payment. That might be because you’ve heard you need to save 20% of the home’s price to put down. Well, that isn’t necessarily the case.

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

As The Mortgage Reports says:

“Although putting down 20% to avoid mortgage insurance is wise if affordable, it’s a myth that this is always necessary. In fact, most people opt for a much lower down payment.”

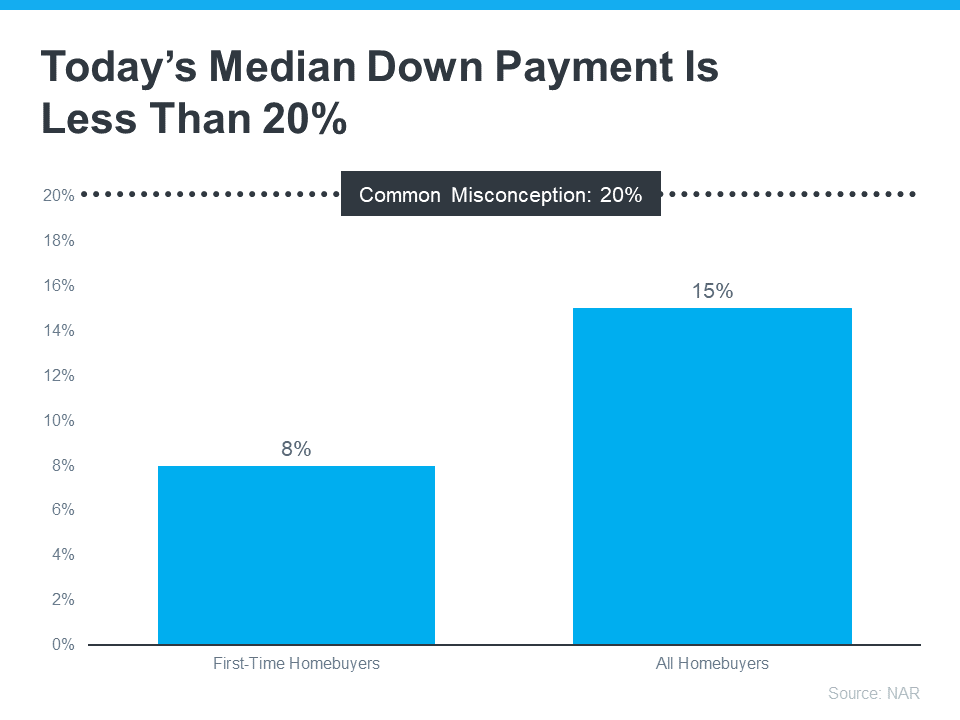

According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, for all homebuyers today it’s only 15%. And it’s even lower for first-time homebuyers at just 8% (see graph below):

The big takeaway? You may not need to save as much as you originally thought.

Learn About Resources That Can Help You Toward Your Goal

According to Down Payment Resource, there are also over 2,000 homebuyer assistance programs in the U.S., and many of them are intended to help with down payments.

Plus, there are loan options that can help too. For example, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for qualified applicants.

With so many resources available to help with your down payment, the best way to find what you qualify for is by consulting with your loan officer or broker. They know about local grants and loan programs that may help you out.

Don’t let the misconception that you have to have 20% saved up hold you back. If you’re ready to become a homeowner, lean on the professionals to find resources that can help you make your dreams a reality. If you put your plans on hold until you’ve saved up 20%, it may actually cost you in the long run. According to U.S. Bank:

“. . . there are plenty of reasons why it might not be possible. For some, waiting to save up 20% for a down payment may “cost” too much time. While you’re saving for your down payment and paying rent, the price of your future home may go up.”

Home prices are expected to keep appreciating over the next 5 years – meaning your future home will likely go up in price the longer you wait. If you’re able to use these resources to buy now, that future price growth will help you build equity, rather than cost you more.

Bottom Line

Keep in mind that you don’t always need a 20% down payment to buy a home. If you’re looking to make a move this year, let’s connect to start the conversation about your homebuying goals.

by John Nyiszter | Mar 4, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

If you want to buy a home, you should know your credit score is a critical piece of the puzzle when it comes to qualifying for a mortgage. Lenders review your credit to see if you typically make payments on time, pay back debts, and more. Your credit score can also help determine your mortgage rate. An article from US Bank explains:

“A credit score isn’t the only deciding factor on your mortgage application, but it’s a significant one. So, when you’re house shopping, it’s important to know where your credit stands and how to use it to get the best mortgage rate possible.”

That means your credit score may feel even more important to your homebuying plans right now since mortgage rates are a key factor in affordability. According to the Federal Reserve Bank of New York, the median credit score in the U.S. for those taking out a mortgage is 770. But that doesn’t mean your credit score has to be perfect. The same article from US Bank explains:

“Your credit score (commonly called a FICO Score) can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you don’t need that score or above to buy a home.”

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan and the mortgage rate you’re able to get. As FICO says:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders may use to determine your actual interest rates.”

If you’re looking for ways to improve your score, Experian highlights some things you may want to focus on:

- Your Payment History: Late payments can have a negative impact by dropping your score. Focus on making payments on time and paying any existing late charges quickly.

- Your Debt Amount (relative to your credit limits): When it comes to your available credit amount, the less you’re using, the better. Focus on keeping this number as low as possible.

- Credit Applications: If you’re looking to buy something, don’t apply for additional credit. When you apply for new credit, it could result in a hard inquiry on your credit that drops your score.

Bottom Line

Finding ways to make your credit score better could help you get a lower mortgage rate. If you want to learn more, talk to a trusted lender.

by John Nyiszter | Feb 29, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

Over the past few months, experts have revised their 2024 home price forecasts based on the latest data and market signals, and they’re even more confident prices will rise, not fall.

So, let’s see exactly how experts’ thinking has shifted – and what’s caused the change.

2024 Home Price Forecasts: Then and Now

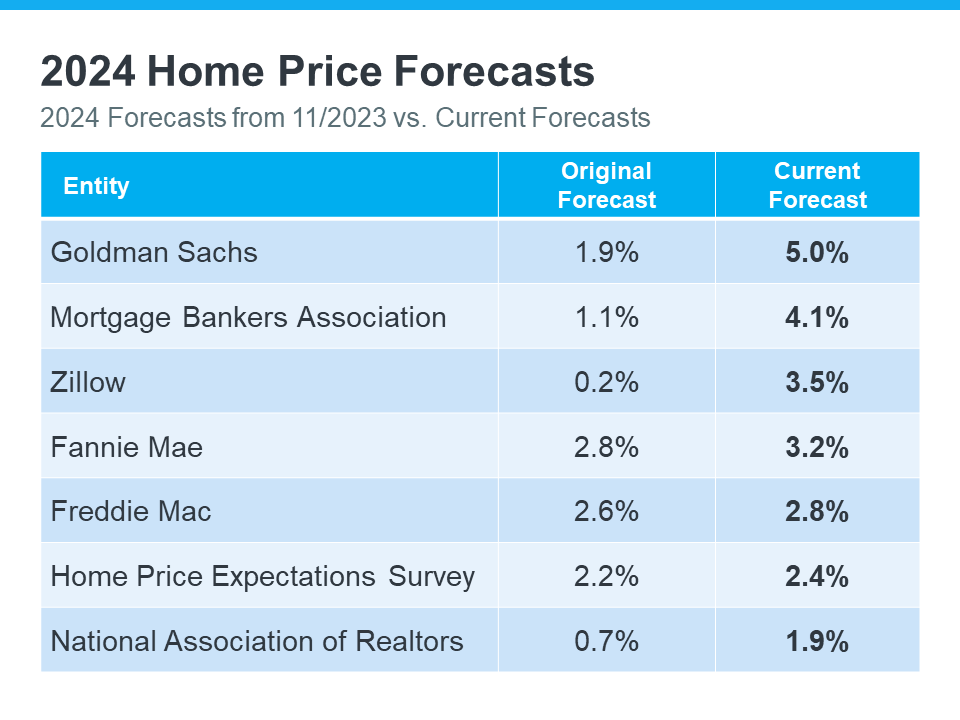

The chart below shows what seven expert organizations think will happen to home prices in 2024. It compares their first 2024 home price forecasts (made at the end of 2023) with their newest projections:

The middle column shows that, at first, these experts thought home prices would only go up a little this year. But if you look at the column on the right, you’ll see they’ve all updated their forecasts and now think prices will go up more than they originally thought. And some of the differences are major.

There are two big factors keeping such strong upward pressure on home prices. The first is how few homes are for sale right now. According to Business Insider:

“Low home inventory is a chronic problem in the US. This has generally kept home prices up . . .”

A lack of housing inventory has been pushing prices up for a long time now – and that’s not expected to change dramatically this year. But what has changed a bit is mortgage rates.

Late last year when most housing market experts were calling for home prices to rise only a little bit in 2024, mortgage rates were up and buyer demand was more moderate.

Now that rates have come down from their peak last October, and with further declines expected over the course of the year, buyer demand has picked up. That increase in demand, along with an ongoing lack of inventory, is what’s caused the experts to feel the upward pressure on prices will be stronger than they expected a couple months ago.

A Look Forward To Get Ahead of the Next Forecast Revisions

Real estate experts regularly revise their home price forecasts as the housing market shifts. It’s a normal part of their job that ensures their projections are always up-to-date and factor in the latest changes in the housing market.

That means they’ll continue to revise their projections as the housing market changes, just as they’ve always done. How those forecasts change next is anyone’s guess, but pay attention to mortgage rates.

If they trend down as the year goes on, as they’re expected to do, that could lead to more buyer demand and even higher home price forecasts.

Basically, it’s all about supply and demand. With supply still so limited, anything that causes demand to go up will likely cause prices to go up, too.

Bottom Line

At first, experts believed home prices would only go up a little this year. But now, they’ve changed their minds and forecast prices will grow even more than they originally thought. Let’s connect so you know what to expect with prices in our area.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

by John Nyiszter | Feb 29, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

Wondering if it still makes sense to sell your house right now? The short answer is, yes. And if you look at the current number of homes for sale, you’ll see two reasons why.

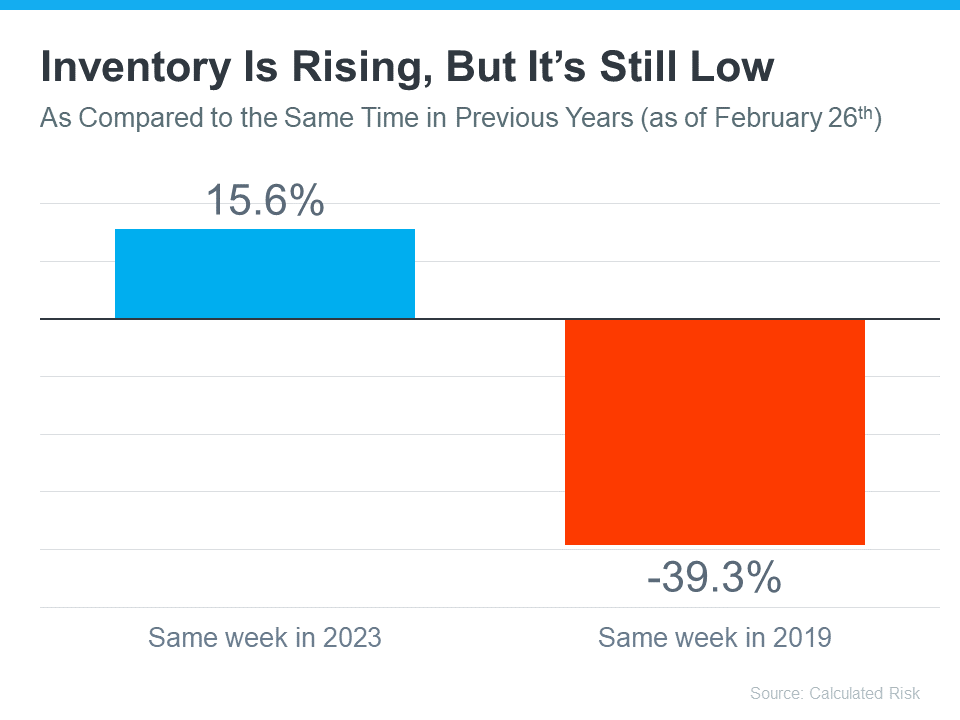

An article from Calculated Risk shows there are 15.6% more homes for sale now compared to the same week last year. That tells us inventory has grown. But going back to 2019, the last normal year in the housing market, there are nearly 40% fewer homes available now:

Here’s a breakdown of how this benefits you when you sell.

1. You Have More Options for Your Move

Are you thinking about selling because your current house is too big, too small, or because your needs have changed? If so, the year-over-year growth gives you more options for your home search. That means it may be less of a challenge to find what you’re looking for.

So, if you were holding off on selling because you were worried you weren’t going to find a home you like, this may be just the good news you needed. Partnering with a local real estate professional can help you make sure you’re up to date on the homes available in your area.

2. You Still Won’t Have Much Competition When You Sell

But to put that into perspective, even though there are more homes for sale now, there still aren’t as many as there’d be in a normal year. Remember, the data from Calculated Risk shows we’re down nearly 40% compared to 2019. And that large a deficit won’t be solved overnight. As a recent article from Realtor.com explains:

“. . . the number of homes for sale and new listing activity continues to improve compared to last year. However the inventory of homes for sale still has a long journey back to pre-pandemic levels.”

For you, that means if you work with an agent to price your house right, it should still get a lot of attention from eager buyers and could sell fast.

Bottom Line

If you’re a homeowner looking to sell, now’s a good time. You’ll have more options when buying your next home, and there’s still not a ton of competition from other sellers. If you’re ready to move, let’s connect to get the ball rolling.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$