by John Nyiszter | Mar 26, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

What’s the Latest with Mortgage Rates?

Recent headlines may leave you wondering what’s next for mortgage rates. Maybe you’d previously heard there were going to be cuts this year that would bring rates down. That refers to the Federal Reserve (the Fed) and what they do to their Fed Funds Rate. While cutting, or lowering, the Fed Funds Rate doesn’t directly determine mortgage rates, it does tend to impact them. But when the Fed met last week, a cut didn’t happen — at least, not yet.

There are a lot of factors the Fed considered in their recent decision and most of them are complex. But you don’t need to be bogged down by those finer details. What you really want is the answer to this question: does that mean mortgage rates aren’t going to fall? Here’s what you need to know.

Mortgage Rates Are Still Expected To Drop This Year

While it hasn’t happened yet, that doesn’t mean it won’t. Even Jerome Powell, the Chairman of the Fed, says they still plan to make cuts this year, assuming inflation cools:

“We believe that our policy rate is likely at its peak for this tightening cycle and that, if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”

When this happens, history shows mortgage rates will likely follow. That means hope isn’t lost. As a recent article from Business Insider explains:

“As inflation comes down and the Fed is able to start lowering rates, mortgage rates should go down, too. . .”

What This Means for You

But you don’t necessarily want to wait for it to happen. Mortgage rates are notoriously hard to forecast. There are so many factors at play and any one of those can change the projections as the economy shifts. And it’s why the experts offer this advice. As Mark Fleming, Chief Economist at First American, says:

“Well, mortgage rate projections are just that, projections, not promises and don’t forget how hard it is to forecast them. . . So my advice is to never try to time the market . . . If one is financially prepared and buying a home aligns with your lifestyle goals, then it could be the right time to purchase. And there’s always the refinance option if mortgage rates are lower in the future.”

Basically, if you’re looking to move and trying to time the market, don’t. If you’re ready, willing, and able to move, it may still be worth it to do it now, especially if you can find the home you’ve been searching for.

Bottom Line

If you’re looking to buy a home, let’s connect so you have someone keeping you up-to-date on mortgage rates and helping you make the best decision possible.

by John Nyiszter | Mar 22, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners

Some Highlights

by John Nyiszter | Mar 20, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

Does It Make Sense To Buy a Home Right Now?

Thinking about buying a home? If so, you’re probably wondering: should I buy now or wait? Nobody can make that decision for you, but here’s some information that can help you decide.

What’s Next for Home Prices?

Each quarter, Fannie Mae and Pulsenomics publish the results of the Home Price Expectations Survey (HPES). It asks more than 100 experts—economists, real estate professionals, and investment and market strategists—what they think will happen with home prices.

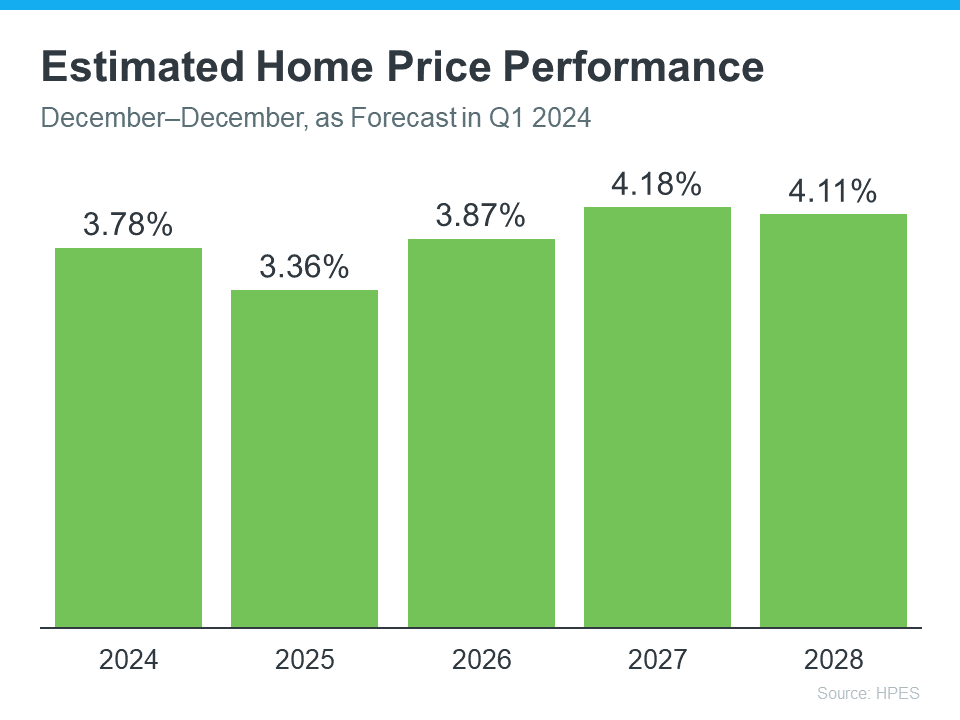

In the latest survey, those experts say home prices are going to keep going up for the next five years (see graph below):

Here’s what all the green on this chart should tell you. They’re not expecting any price declines. Instead, they’re saying we’ll see a 3-4% rise each year.

And even though home prices aren’t expected to climb by as much in 2025 as they are 2024, keep in mind these increases can really add up over time. It works like this. If these experts are right and your home’s value goes up by 3.78% this year, it’s set to grow another 3.36% next year. And another 3.87% the year after that.

What Does This Mean for You?

Knowing that prices are forecasted to keep going up should make you feel good about buying a home. That’s because it means your home is an asset that’s projected to grow in value in the years ahead.

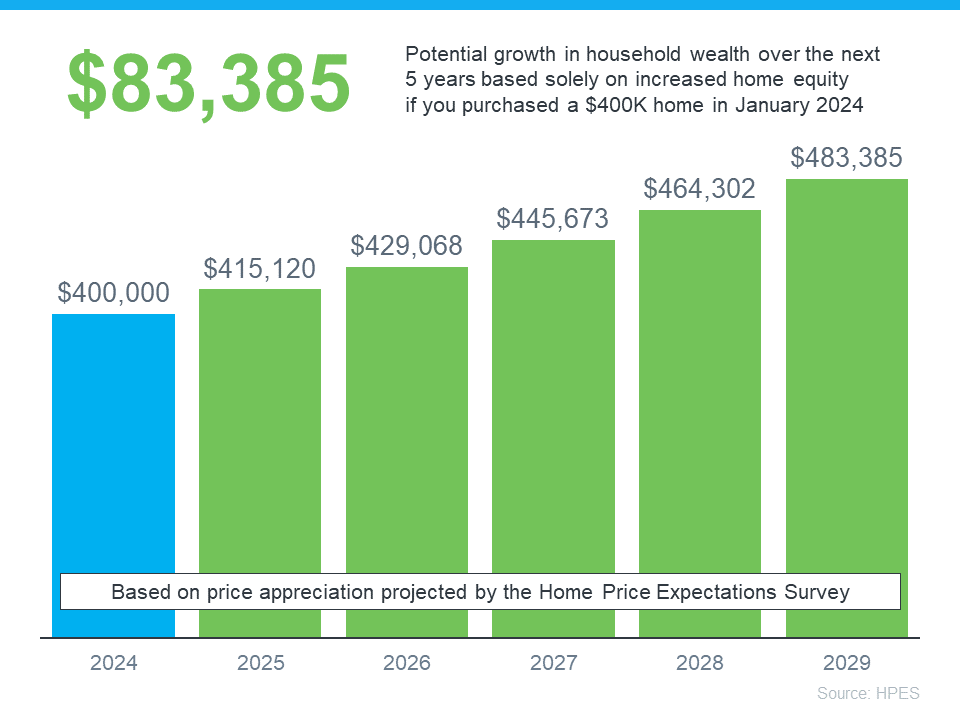

If you’re not convinced yet, maybe these numbers will get your attention. They show how a typical home’s value could change over the next few years using expert projections from the HPES. Check out the graph below:

In this example, imagine you bought a home for $400,000 at the start of this year. Based on these projections, you could end up gaining over $83,000 in household wealth over the next five years as your home grows in value.

Of course, you could also wait – but if you do, buying a home is just going to end up costing you more.

Bottom Line

If you’re thinking it’s time to get your own place, and you’re ready and able to do so, buying now might make sense. Your home is expected to keep getting more valuable as prices go up. Let’s team up to start looking for your next home today.

by John Nyiszter | Mar 4, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

There’s a lot of confusion in the market about what’s happening with day-to-day movement in mortgage rates right now, but here’s what you really need to know: compared to the near 8% peak last fall, mortgage rates have trended down overall.

And if you’re looking to buy or sell a home, this is a big deal. While they’re going to continue to bounce around a bit based on various economic drivers (like inflation and reactions to the consumer price index, or CPI), don’t let the short-term volatility distract you. The experts agree the overarching downward trend should continue this year.

While we won’t see the record-low rates homebuyers got during the pandemic, some experts think we should see rates dip below 6% later this year. As Dean Baker, Senior Economist, Center for Economic Research, says:

“They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.”

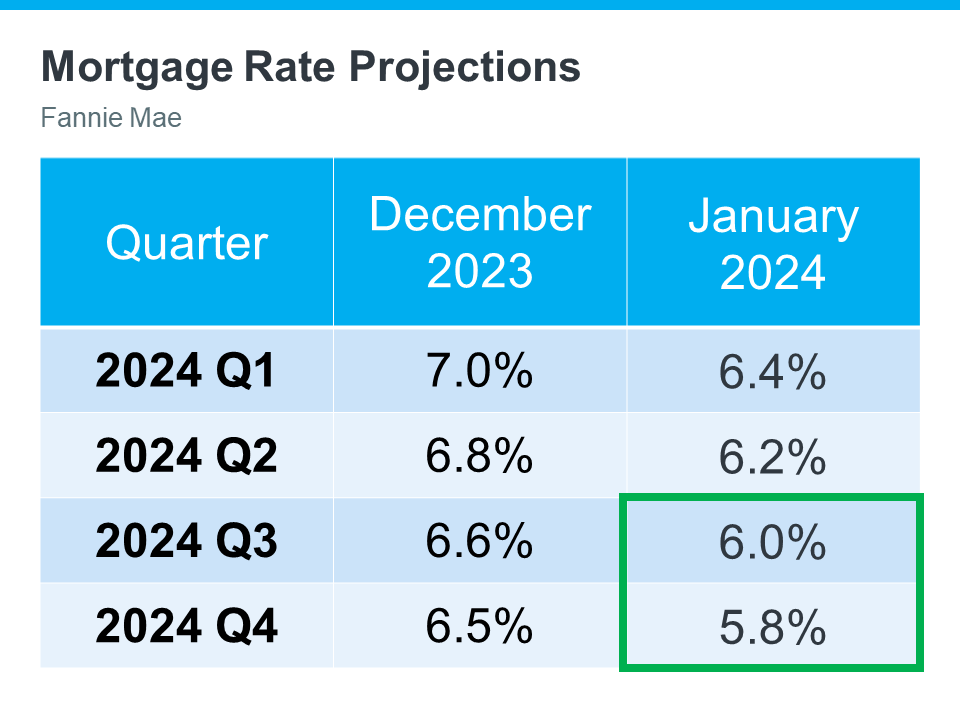

And Baker isn’t the only one saying this is a possibility. The latest Fannie Mae projections also indicate we may see a rate below 6% by the end of this year (see the green box in the chart below):

The chart shows mortgage rate projections for 2024 from Fannie Mae. It includes the one that came out in December, and compares it to the updated 2024 forecast they released just one month later. And if you look closely, you’ll notice the projections are on the way down.

It’s normal for experts to re-forecast as they watch current market trends and the broader economy, but what this shows is experts are feeling confident rates should continue to decline, if inflation cools.

What This Means for You

But remember, no one can say for sure what will happen (and by when) – and short-term volatility is to be expected. So, don’t let small fluctuations scare you. Focus on the bigger picture.

If you’ve found a home you love in today’s market – especially where finding a home that meets your budget and your needs can be a challenge – it’s probably not a good idea to try to time the market and wait until rates drop below 6%.

With rates already lower than they were last fall, you have an opportunity in front of you right now. That’s because even a small quarter point dip in rates gives your purchasing power a boost.

Bottom Line

If you wanted to move last year but were holding off hoping rates would fall, now may be the time to act. Let’s connect to get the ball rolling.

by John Nyiszter | Mar 4, 2024 | condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

If you’re planning to buy your first home, saving up for all the costs involved can feel daunting, especially when it comes to the down payment. That might be because you’ve heard you need to save 20% of the home’s price to put down. Well, that isn’t necessarily the case.

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

As The Mortgage Reports says:

“Although putting down 20% to avoid mortgage insurance is wise if affordable, it’s a myth that this is always necessary. In fact, most people opt for a much lower down payment.”

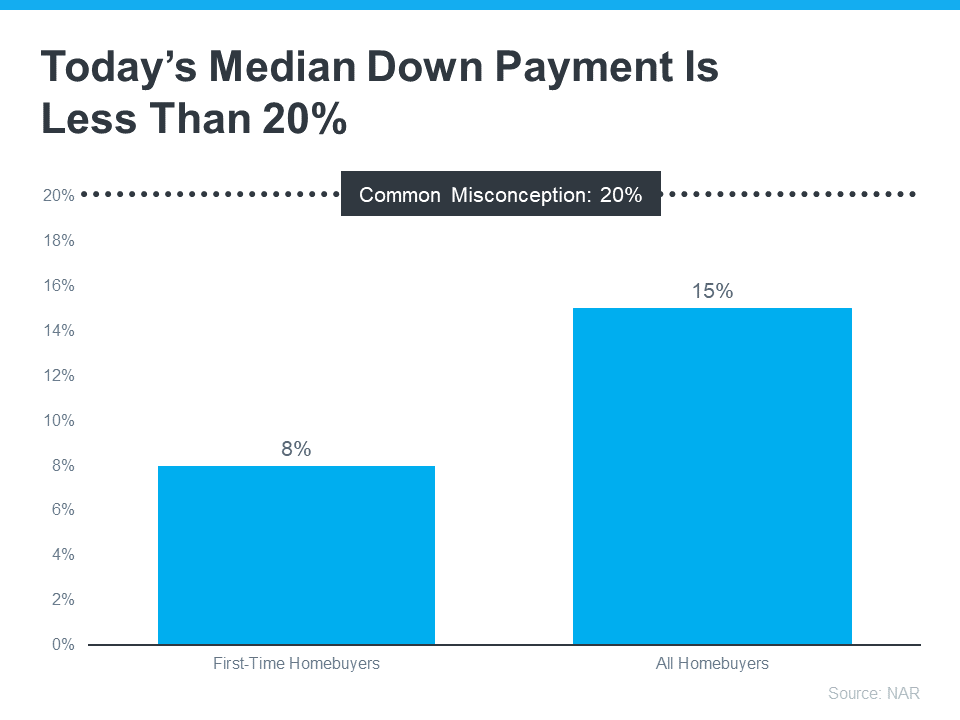

According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, for all homebuyers today it’s only 15%. And it’s even lower for first-time homebuyers at just 8% (see graph below):

The big takeaway? You may not need to save as much as you originally thought.

Learn About Resources That Can Help You Toward Your Goal

According to Down Payment Resource, there are also over 2,000 homebuyer assistance programs in the U.S., and many of them are intended to help with down payments.

Plus, there are loan options that can help too. For example, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for qualified applicants.

With so many resources available to help with your down payment, the best way to find what you qualify for is by consulting with your loan officer or broker. They know about local grants and loan programs that may help you out.

Don’t let the misconception that you have to have 20% saved up hold you back. If you’re ready to become a homeowner, lean on the professionals to find resources that can help you make your dreams a reality. If you put your plans on hold until you’ve saved up 20%, it may actually cost you in the long run. According to U.S. Bank:

“. . . there are plenty of reasons why it might not be possible. For some, waiting to save up 20% for a down payment may “cost” too much time. While you’re saving for your down payment and paying rent, the price of your future home may go up.”

Home prices are expected to keep appreciating over the next 5 years – meaning your future home will likely go up in price the longer you wait. If you’re able to use these resources to buy now, that future price growth will help you build equity, rather than cost you more.

Bottom Line

Keep in mind that you don’t always need a 20% down payment to buy a home. If you’re looking to make a move this year, let’s connect to start the conversation about your homebuying goals.

by John Nyiszter | Mar 4, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

If you want to buy a home, you should know your credit score is a critical piece of the puzzle when it comes to qualifying for a mortgage. Lenders review your credit to see if you typically make payments on time, pay back debts, and more. Your credit score can also help determine your mortgage rate. An article from US Bank explains:

“A credit score isn’t the only deciding factor on your mortgage application, but it’s a significant one. So, when you’re house shopping, it’s important to know where your credit stands and how to use it to get the best mortgage rate possible.”

That means your credit score may feel even more important to your homebuying plans right now since mortgage rates are a key factor in affordability. According to the Federal Reserve Bank of New York, the median credit score in the U.S. for those taking out a mortgage is 770. But that doesn’t mean your credit score has to be perfect. The same article from US Bank explains:

“Your credit score (commonly called a FICO Score) can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you don’t need that score or above to buy a home.”

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan and the mortgage rate you’re able to get. As FICO says:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders may use to determine your actual interest rates.”

If you’re looking for ways to improve your score, Experian highlights some things you may want to focus on:

- Your Payment History: Late payments can have a negative impact by dropping your score. Focus on making payments on time and paying any existing late charges quickly.

- Your Debt Amount (relative to your credit limits): When it comes to your available credit amount, the less you’re using, the better. Focus on keeping this number as low as possible.

- Credit Applications: If you’re looking to buy something, don’t apply for additional credit. When you apply for new credit, it could result in a hard inquiry on your credit that drops your score.

Bottom Line

Finding ways to make your credit score better could help you get a lower mortgage rate. If you want to learn more, talk to a trusted lender.