by John Nyiszter | Feb 29, 2024 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

Over the past few months, experts have revised their 2024 home price forecasts based on the latest data and market signals, and they’re even more confident prices will rise, not fall.

So, let’s see exactly how experts’ thinking has shifted – and what’s caused the change.

2024 Home Price Forecasts: Then and Now

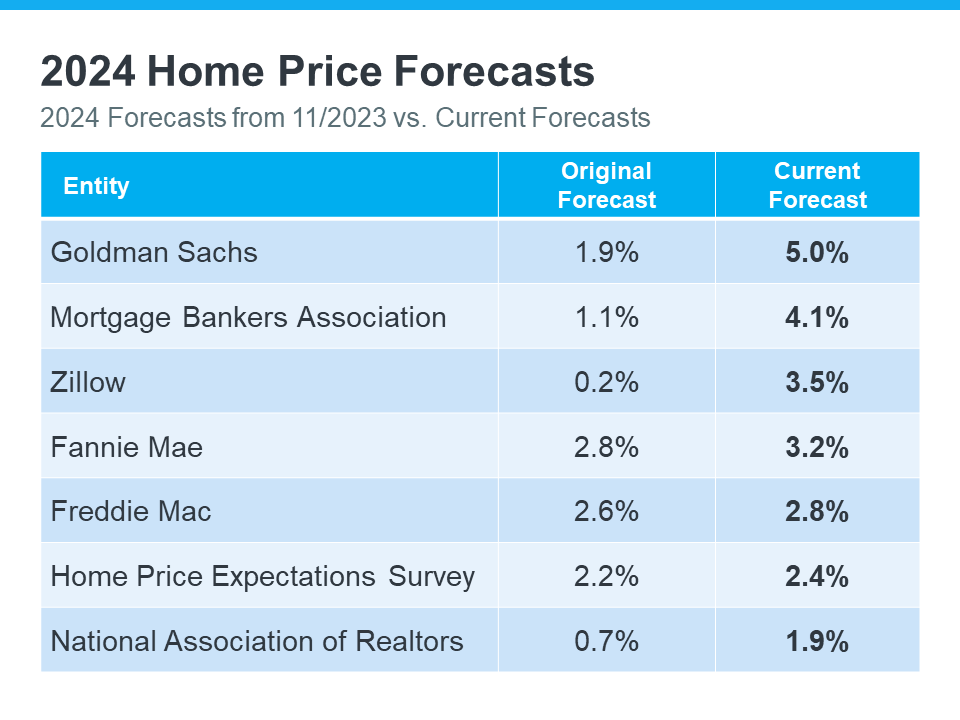

The chart below shows what seven expert organizations think will happen to home prices in 2024. It compares their first 2024 home price forecasts (made at the end of 2023) with their newest projections:

The middle column shows that, at first, these experts thought home prices would only go up a little this year. But if you look at the column on the right, you’ll see they’ve all updated their forecasts and now think prices will go up more than they originally thought. And some of the differences are major.

There are two big factors keeping such strong upward pressure on home prices. The first is how few homes are for sale right now. According to Business Insider:

“Low home inventory is a chronic problem in the US. This has generally kept home prices up . . .”

A lack of housing inventory has been pushing prices up for a long time now – and that’s not expected to change dramatically this year. But what has changed a bit is mortgage rates.

Late last year when most housing market experts were calling for home prices to rise only a little bit in 2024, mortgage rates were up and buyer demand was more moderate.

Now that rates have come down from their peak last October, and with further declines expected over the course of the year, buyer demand has picked up. That increase in demand, along with an ongoing lack of inventory, is what’s caused the experts to feel the upward pressure on prices will be stronger than they expected a couple months ago.

A Look Forward To Get Ahead of the Next Forecast Revisions

Real estate experts regularly revise their home price forecasts as the housing market shifts. It’s a normal part of their job that ensures their projections are always up-to-date and factor in the latest changes in the housing market.

That means they’ll continue to revise their projections as the housing market changes, just as they’ve always done. How those forecasts change next is anyone’s guess, but pay attention to mortgage rates.

If they trend down as the year goes on, as they’re expected to do, that could lead to more buyer demand and even higher home price forecasts.

Basically, it’s all about supply and demand. With supply still so limited, anything that causes demand to go up will likely cause prices to go up, too.

Bottom Line

At first, experts believed home prices would only go up a little this year. But now, they’ve changed their minds and forecast prices will grow even more than they originally thought. Let’s connect so you know what to expect with prices in our area.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

by John Nyiszter | Feb 28, 2023 | condo owners, condos, First Time Home Buyers, FSBO, Home Owners, Home Sellers, investment properties, luxury homes, townhome owners, Uncategorized

What You Should Know About Rising Mortgage Rates

After steadily falling over the winter, mortgage rates have started to rise in recent weeks. This is concerning to some potential homebuyers as the combination of higher mortgage rates and higher prices have made homes less affordable. So, if you’re planning to purchase a home this year, you too may be wondering if now’s the right time to buy or if you should hold off on your search until rates come back down.

The recent uptick in rates has been driven by what’s happening with inflation. Joel Kan, Vice President and Deputy Chief Economist at the Mortgage Bankers Association (MBA), explains:

“Mortgage rates increased across the board last week, pushed higher by market expectations that inflation will persist, thus requiring the Federal Reserve to keep monetary policy restrictive for a longer time.”

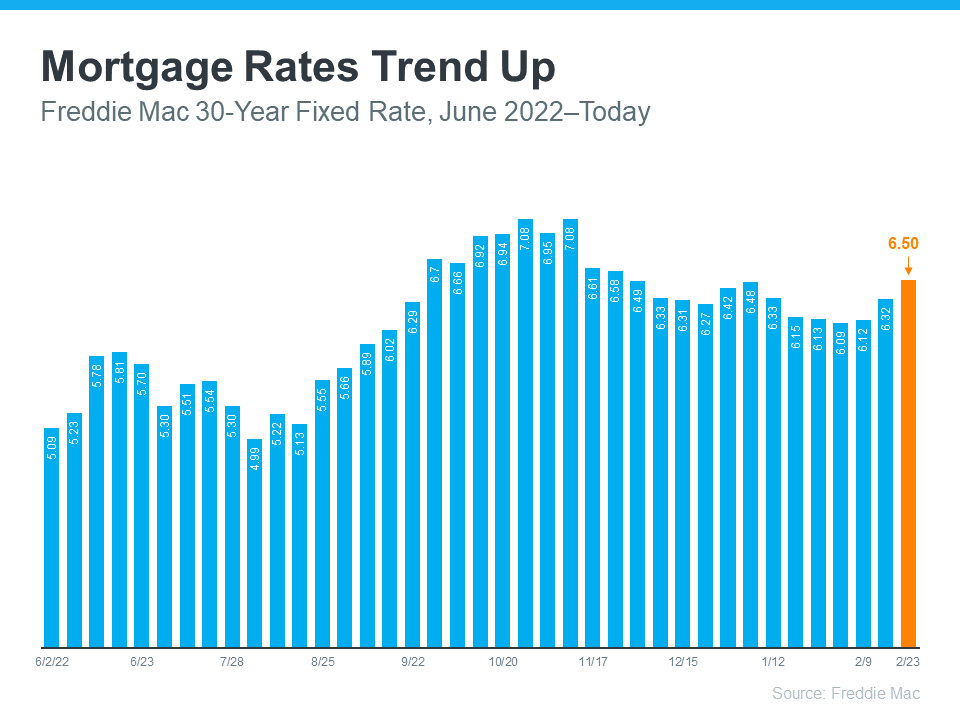

The most recent weekly average 30-year fixed mortgage rate reported by Freddie Mac is 6.5%. It’s the third week in a row that rates have increased and puts them at the highest point they’ve been this year (see graph below):

Advice for Home Shoppers

If you’re thinking about pausing your home search because rates have started to go up again, you may want to reconsider. This could actually be an opportunity to buy the home you’ve been searching for. According to the MBA, mortgage applications declined by 13.3% in just one week, so it appears the rise in mortgage rates is leading some potential homebuyers to pull back on their search for a new home.

So, what does that mean for you? If you stay the course, you’ll likely face less competition among other buyers when you’re looking for a home. This is welcome relief in a market that has so few homes for sale.

Bottom Line

Over the last few weeks, mortgage rates have risen. But that doesn’t mean you should delay your plans to buy a home. In fact, it could mean the opposite if you want to take advantage of less buyer competition. Let’s connect today to explore the options in our local market.

by jnyiszter | Oct 20, 2022 | baby boomers, condo owners, condos, First Time Home Buyers, FSBO, gen z, Generation X, home buyers, Home Owners, Home Sellers, investment properties, luxury homes, millennials, property owners, townhome owners, townhomes, Uncategorized

What’s Ahead for Home Prices?

As the housing market cools in response to the dramatic rise in mortgage rates, home price appreciation is cooling as well. And if you’re following along with headlines in the media, you’re probably seeing a wide range of opinions calling for everything from falling home prices to ongoing appreciation. But what’s true? What’s most likely to happen moving forward?

While opinions differ, the most likely outcome is we’ll fall somewhere in the middle of slight appreciation and slight depreciation. Here’s a look at the latest expert projections so you have the best information possible today.

What the Experts Are Saying About Home Prices Next Year

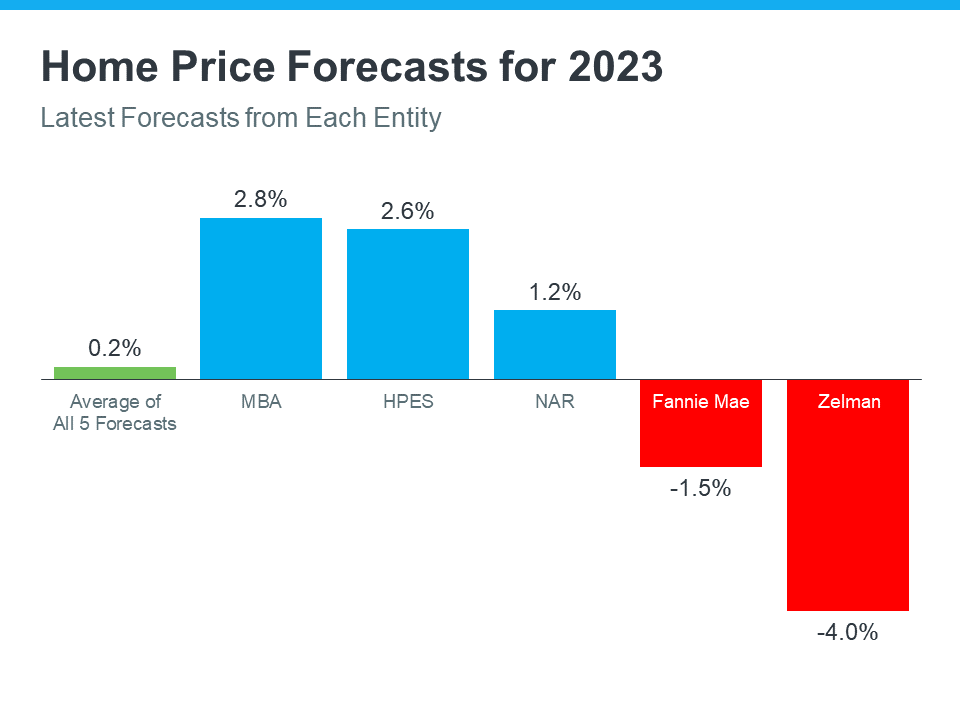

The graph below shows the most up-to-date forecasts from five experts in the housing industry. These are the experts that have most recently updated their projections based on current market trends:

As the graph shows, the three blue bars represent experts calling for ongoing home price appreciation, just at a more moderate rate than recent years. The red bars on the graph are experts calling for home price depreciation.

While there isn’t a clear consensus, if you take the average (shown in green) of all five of these forecasts, the most likely outcome is, nationally, home price appreciation will be fairly flat next year.

What Does This Mean?

Basically, experts are divided on what’s ahead for 2023. Home prices will likely depreciate slightly in some markets and will continue to gain ground in others. It all depends on the conditions in your local market, like how overheated that market was in recent years, current inventory levels, buyer demand, and more.

The good news is home prices are expected to return to more normal levels of appreciation rather quickly. The latest forecast from Wells Fargo shows that, while they feel prices will fall in 2023, they think prices will recover and net positive in 2024. That forecast calls for 3.1% appreciation in 2024, which is a number much more in line with the long-term average of 4% annual appreciation.

And the Home Price Expectation Survey (HPES) from Pulsenomics, a poll of over one hundred industry experts, also calls for ongoing appreciation of roughly 2.6 to 4% from 2024-2026. This goes to show, even if prices decline slightly next year, it’s not expected to be a lasting trend.

As Jason Lewris, Co-Founder and Chief Data Officer for Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

Don’t let fear or uncertainty change your plans. If you’re unsure about where prices are headed or how to make sense of what’s going on in today’s housing market, reach out to a local real estate professional for the guidance you need each step of the way.

Bottom Line

The housing market is shifting, and it’s a confusing place right now. Let’s connect so you have a trusted real estate professional to help you make confident and informed decisions about what’s happening in our market.

by jnyiszter | Oct 12, 2022 | baby boomers, condo owners, condos, First Time Home Buyers, FSBO, gen z, Generation X, home buyers, Home Owners, Home Sellers, investment properties, luxury homes, millennials, property owners, townhome owners, townhomes, Uncategorized

The Cost of Waiting for Mortgage Rates To Go Down

Mortgage rates have increased significantly in recent weeks. And that may mean you have questions about what this means for you if you’re planning to buy a home. Here’s some information that can help you make an informed decision when you set your homebuying plans.

The Impact of Rising Mortgage Rates

As mortgage rates rise, they impact your purchasing power by raising the cost of buying a home and limiting how much you can comfortably afford. Here’s how it works.

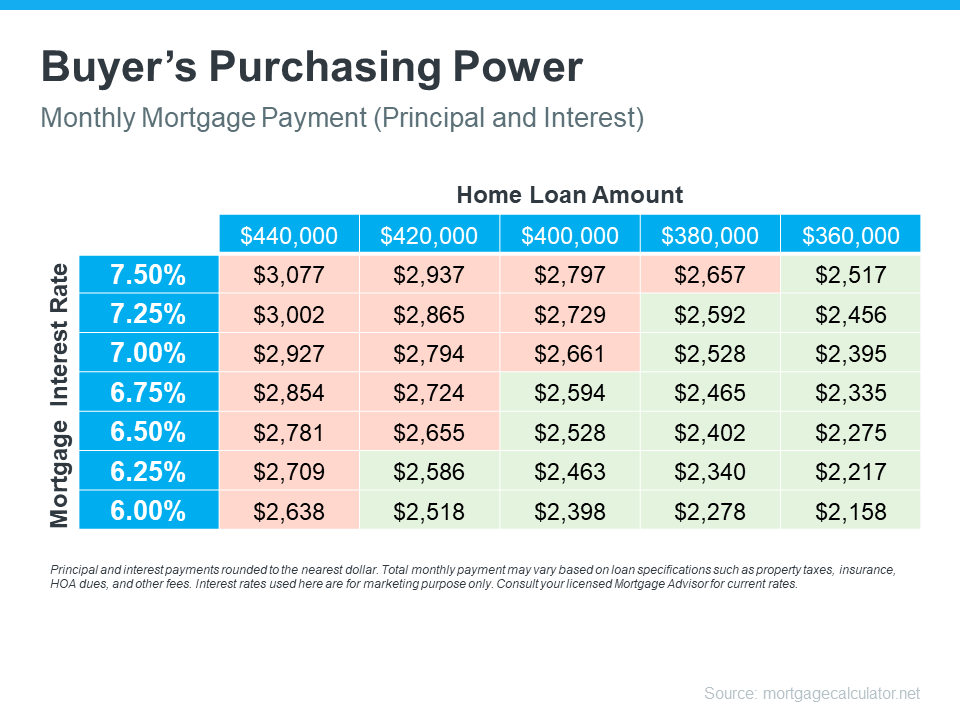

Let’s assume you want to buy a $400,000 home (the median-priced home according to the National Association of Realtors is $389,500). If you’re trying to shop at that price point and keep your monthly payment about $2,500-2,600 or below, here’s how your purchasing power can change as mortgage rates climb (see chart below). The red shows payments above that threshold and the green indicates a payment within your target range.

As the chart shows, as rates go up, the amount you can afford to borrow decreases and that may mean you have to look at homes at a different price point. That’s why it’s important to work with a real estate advisor to understand how mortgage rates impact your monthly mortgage payment at various home loan amounts.

Are Mortgage Rates Going To Go Down?

The rise in mortgage rates and the resulting decrease in purchasing power may leave you wondering if you should wait for rates to go down before making your purchase. Realtor.com says this about where rates could go from here:

“Many homebuyers likely winced . . . upon hearing that the Federal Reserve yet again boosted its short-term interest rates by three-quarters of a percentage point—a move that’s pushing mortgage rates through the roof. And the already high rates are just going to get higher.”

So, if you’re waiting for mortgage rates to drop, you may be waiting for a while as the Federal Reserve works to get inflation under control.

And if you’re considering renting as your alternative while you wait it out, remember that’s going to get more expensive with time too. As Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), says:

“There is no doubt that these higher rates hurt housing affordability. Nevertheless, apart from borrowing costs, rents additionally rose at their highest pace in nearly four decades.”

Basically, it is true that it costs more to buy a home today than it did last year, but the same is true for renting. This means, either way, you’re going to be paying more. The difference is, with homeownership, you’re also gaining equity over time which will help grow your net worth. The question now becomes: what makes more sense for you?

Bottom Line

Each person’s situation is unique. To make the best decision for you, let’s connect to explore your options.